While gold arguably deserves attention for another day, the significant early-morning volatility on AUDUSD warrants its selection as the Chart of the Day, following the Reserve Bank of Australia’s (RBA) interest rate decision.

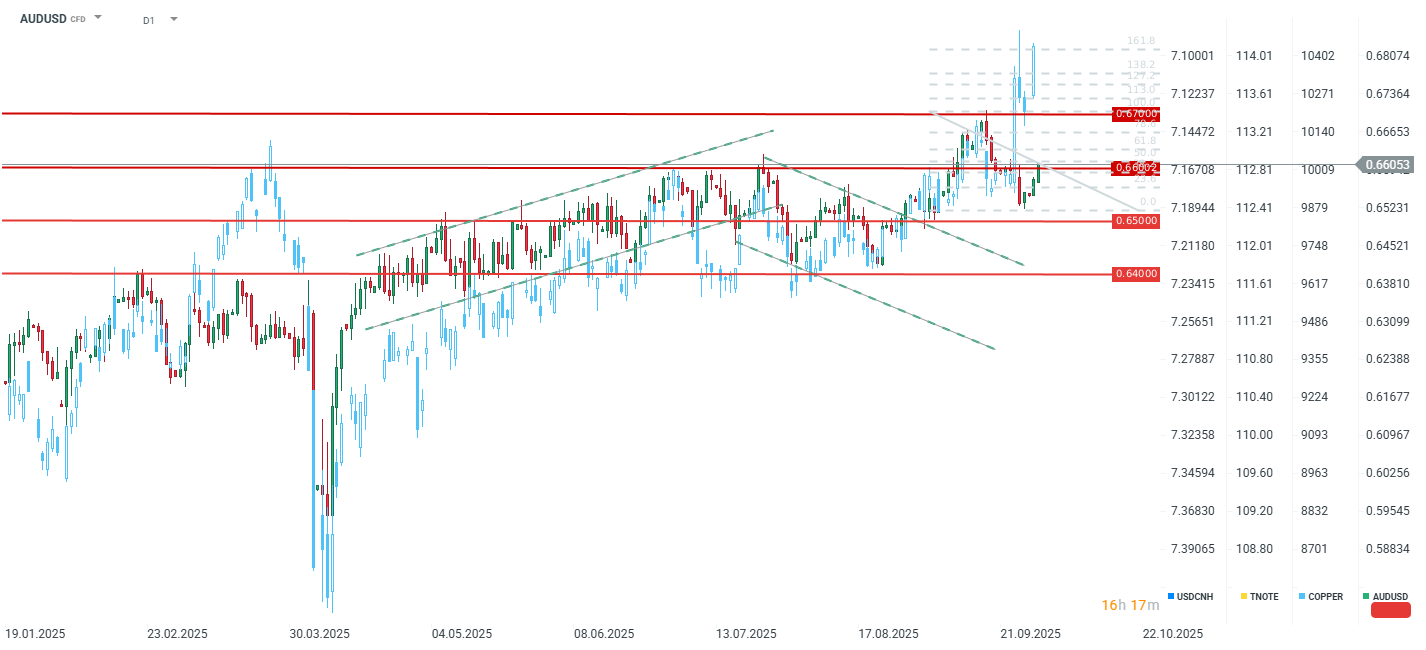

The RBA kept its cash rate unchanged, a unanimous decision that delivered a distinctly hawkish shift in the assessment of the inflation outlook. The decision was in line with expectations, but the accompanying statement was clearly hawkish. The latest communiqué emphasized that the pace of decline in core inflation has slowed, which the market interpreted as a firm signal against further near-term rate cuts.

Improving macroeconomic data—notably the rebound in consumption and stabilization in the labour market—negates the immediate need for cuts, further supporting the Australian Dollar. The RBA noted that economic activity is gradually picking up and the labour market remains somewhat tight. Global uncertainty persists, particularly concerning US trade policy, though the most extreme scenarios are now deemed less likely, and the influence of tariffs on the economy should be contained.

The RBA maintains a cautious approach, stating its readiness to adjust policy as more data emerges. The bank also stressed that it requires time to assess the full effects of previous rate cuts. The market reaction was swift: AUD/USD rose sharply as investors priced out the risk of further rate cuts, supporting the currency in the short term. The cyclical pause may be prolonged if inflation remains elevated and the economic rebound holds. Moreover, rising commodity prices are positive for Australia, driving increased export revenues. Stronger expansion in China also points to faster Australian growth in the near term.

The AUDUSD pair has broken above the 0.6600 level and is testing the 50.0% Fibonacci retracement of the last downtrend within the broader uptrend. As evidenced by copper prices continuing their rally, this commodity strength acts as a further tailwind for the Australian Dollar.

It is also worth noting that the Australian Dollar, when measured against the New Zealand Dollar, sees the AUDNZD pair hitting 1.14, its highest level since 2022. While this is a rare sight over the past 12 years, the pair traded significantly higher at the end of the previous decade, suggesting potential for substantial further gains in the event of a global recovery. Furthermore, a notable divergence is currently observed in the monetary policy stances of Australia and New Zealand.

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street