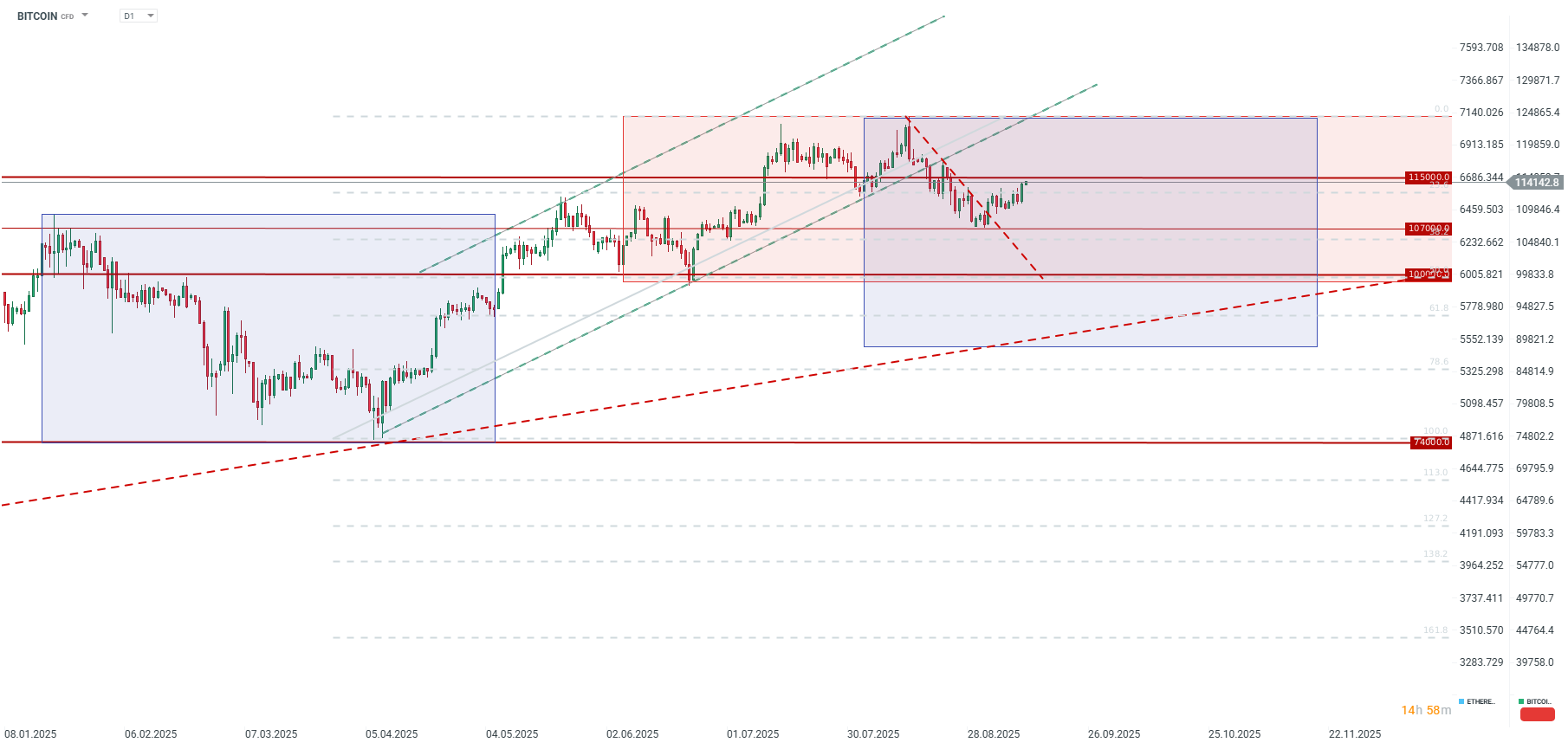

Yesterday, Bitcoin broke through its short-term resistance around $113,000, simultaneously breaching the 23.6% Fibonacci retracement of its most recent major downward impulse. This move follows a breakout from a downward correction at the beginning of September, which negated a potential double-top formation above the $120,000 level.

One of the key drivers behind this rally is anticipation of a larger rate cut from the Fed, which could lead to a weaker dollar. Although the EURUSD pair ultimately retreated below the 1.1700 level, the potential for a more aggressive cut could weigh on the dollar. Yesterday’s PPI inflation data fueled hopes for a larger cut, and today at 1:30 PM BST, we will get the crucial CPI inflation figures. While inflation is expected to rise to 2.9% year-on-year due to tariffs, a lower PPI reading may suggest less upward pressure than previously thought.

What else could be fueling Bitcoin's momentum?

-

ETF Inflows: Bitcoin ETFs saw inflows of over $750 million on Wednesday, September 10.

-

Net inflows for September have already surpassed $1 billion, reversing the outflows seen in August.

-

Whale Accumulation: On-chain data reveals "massive" accumulation by "whale" investors in August, amounting to approximately $3 billion. The number of addresses holding at least 100 BTC has reached a record 19,130, surpassing the previous peak from 2017.

-

Shrinking Exchange Supply: The available supply of Bitcoin on exchanges is dwindling. Bitcoin now accounts for less than 11% of cryptocurrencies on exchanges, the lowest level since 2018. About 70% of the total Bitcoin supply has not changed hands for at least a year, signaling accumulation by long-term investors.

-

Corporate Adoption: A growing number of companies are opting to hold a portion of their assets in Bitcoin. According to AInvest data, corporations and related institutions (ETFs, governments, etc.) now hold 3.7 million BTC.

-

Reduced Leverage: Glassnode data indicates that the leverage ratio used for Bitcoin trading has fallen significantly this year, suggesting a shift from speculation towards long-term institutional allocation.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report