Bitcoin price slightly rebounds after earlier declines in the day. Over the weekend, we saw a sharp drop, particularly on Sunday when Bitcoin's price fell below $60,000 to $57,600.

Important events from the weekend:

-

Celsius sues Tether for $3.5B, alleging improper BTC collateral liquidation during bankruptcy, seeking Bitcoin returns and damages.

-

Former SEC official warns Morgan Stanley’s Bitcoin ETF push could trigger intense compliance scrutiny, calling it a death wish.

-

The SEC delays its decision on Hashdex's proposed Bitcoin and Ether ETF until Sept. 30, 2024, for further review.

-

Cboe re-filed its application to list options on spot Bitcoin ETFs, signaling potential SEC engagement, despite initial withdrawal.

-

Russia legalizes Bitcoin and crypto mining, allowing specified entities and individuals within energy limits to mine, boosting BRICS' digital currency plans.

-

XRP surged 26% as Ripple hailed a $125M SEC penalty as a “victory,” signaling no classification of XRP as a security, nearing lawsuit's end.

-

Franklin Templeton launches its blockchain-based money market fund, FOBXX, on Ethereum's Layer-2 Arbitrum, expanding retail access.

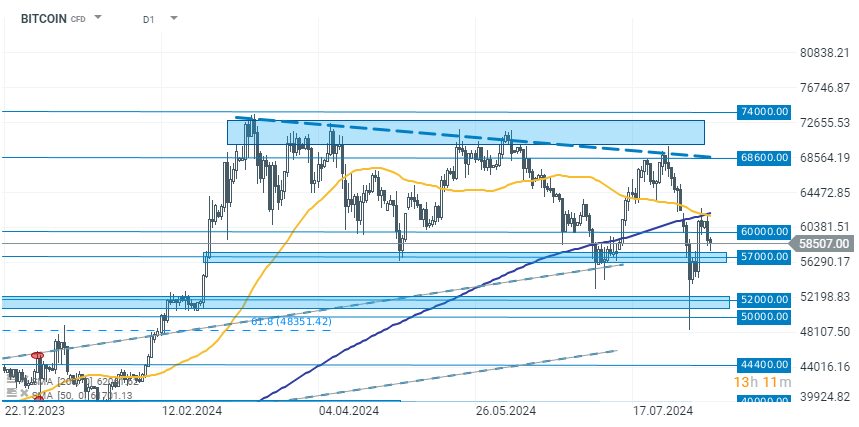

Bitcoin (D1 Interval)

Bitcoin's price is slightly recovering from earlier losses, and we currently see a price increase to around $58,700. Interestingly, much larger gains can be observed among smaller projects and Ethereum. Altcoin market capitalization gains 1.80%, while Ethereum is up 1.10%.

Based on technical analysis, after a strong recovery from earlier declines, Bitcoin's upward movement halted around the 200-day SMA at approximately $62,000. Over the weekend, we saw another drop to the support zone above $57,000. Currently, the key will be maintaining this level and returning above $60,000. If the bulls can hold this zone, we can expect further increases above $62,000. Otherwise, the most critical level to maintain will be the previously mentioned $57,000 support zone.

Source: xStation 5

BITCOIN: Is Kevin Warsh the final nail in the bulls’ coffin? 🔨

🚨Bitcoin slides 5% testing local lows near $84k level

Cosmic increases in precious metals, yen in turbo mode! 🚀

Crypto news: Bitcoin slips back to $87k 📉 Bear market signal?