Cryptocurrencies traded under pressure over the weekend and the drop extended into Monday's morning hours. Bitcoin traded down over 3% lower at one point today and briefly broke below the $16,000 mark. Troubles in the crypto industry, namely on alleged issues of Crypto.com cryptocurrency exchanges, were adding fuel to a sell-off. Plunge was halted shortly before the launch of the European stock market session following comments from Binance CEO. He said that he will advocate for a launch of an industry recovery fund in order to limit damage from potential future cryptocurrency exchange failures. Crypto.com CEO also stepped in to assure investors that his exchange has a strong balance sheet, maintains 1:1 reserve ratio and does not engage in lending to third parties limiting any counterparty risk. Those comments, mostly from Binance CEO, triggered a recovery move on cryptocurrencies, with Bitcoin erasing all of previous losses.

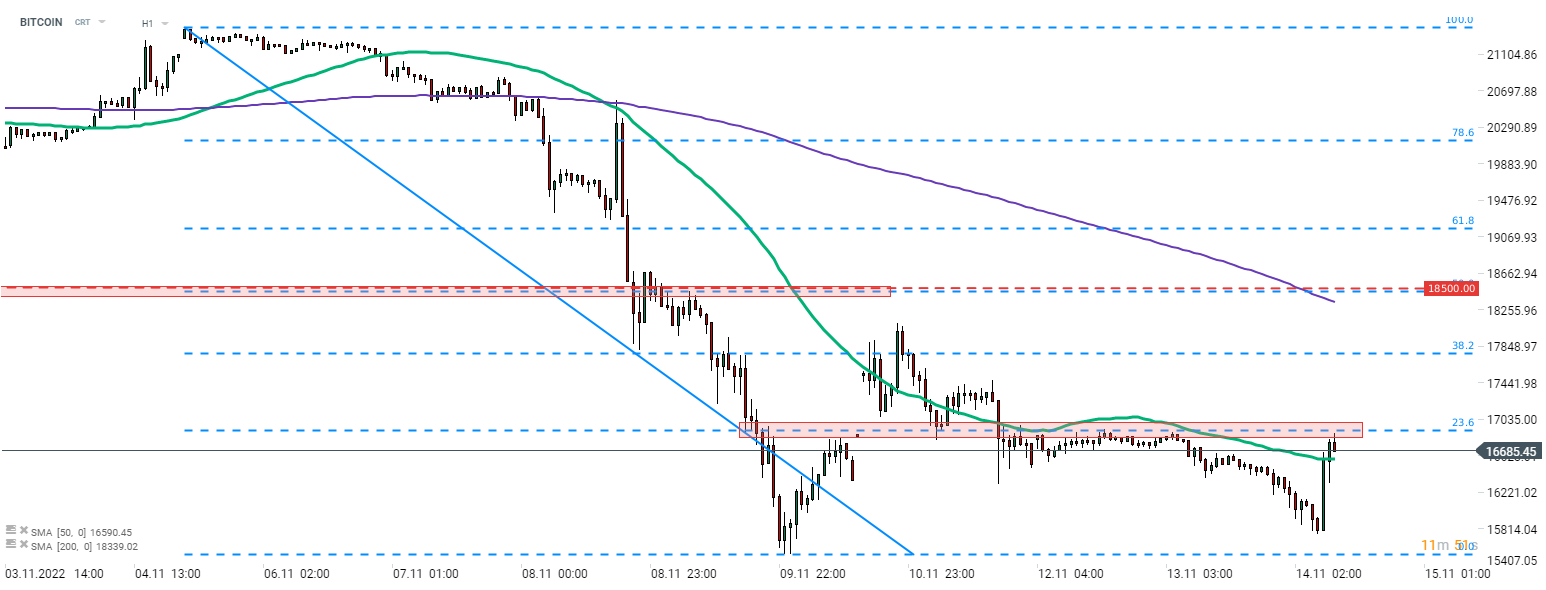

Taking a look at the Bitcoin chart at the H1 interval, we can see that the cryptocurrency experienced a strong upward move this morning. BITCOIN jumped from around $15,800 prior to Binance CEO comments to a daily high near $16,900, breaking above 50-period moving average in the process. The first attempt at breaking above 23.6% retracement in the $17,000 area was a failed one bitcoin continues to trade nearby.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?