The Bitcoin halving event took place overnight from Friday to Saturday. Despite many speculations, during the event itself, there were no significant movements in the cryptocurrency market. On one hand, this was due to the weekend, during which liquidity in the cryptocurrency market is limited. On the other hand, the event itself does not have a major impact on the price in the short term.

Halving means that the rewards for each newly mined block are halved. Only in the long term should the halving of supply positively affect the BTC price. It is also worth noting the Altcoin sector, which has evidently performed better since the halving. The total capitalization of smaller projects grew from $630 billion to $675 billion, an increase of over 7.00%.

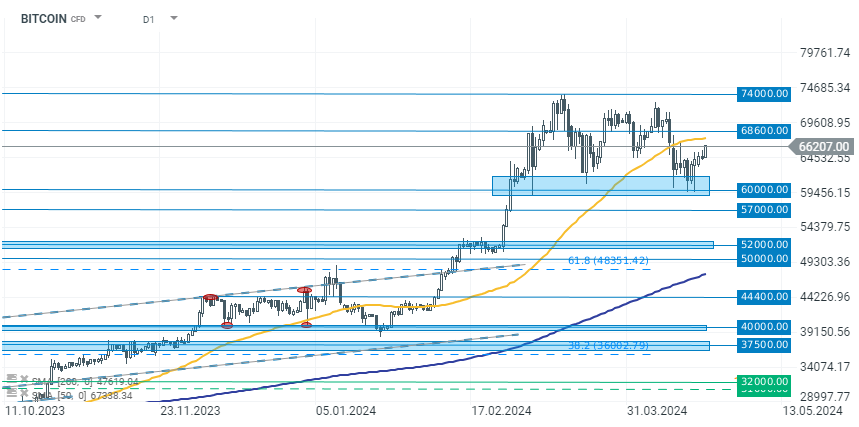

Bitcoin (D1 interval)

Nevertheless, since the halving, investors in the cryptocurrency market have been in better spirits. The price of Bitcoin has been calmly and slowly rising from around $64k to nearly $66k currently. Today, BTC is recording close to a 2.0% increase. Bitcoin defended support last week around the $60k level and remains in a fairly wide consolidation channel between $60k-$72k. Any movement outside this zone could signify the start of a new trend. However, recent days suggest that bulls will likely want to retest levels above $70k. Otherwise, maintaining the support level around $60k will be crucial.

Source: xStation 5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?