Recently, many events have overlapped and influenced the prevailing sentiment on the cryptocurrency market.

On the one hand, we observe weakening bulls on the broader financial market after high index results in the first quarter of this year. Investors are trying to price in new quarterly reports published by the largest technology companies in the US and deteriorating macroeconomic data, which are starting to forecast the upcoming recession on the financial markets.

On the other hand, a lot has happened in the crypto market space. The recent hearing of SEC chairman Gary Gancler did not bring any new news. The SEC chairman continued his narrative without any explanation that all cryptocurrencies except BTC should be considered security - despite many questions from the House Financial Services Committee.

Another wave of declines came today after the news about Coinbase suing the SEC. According to the information provided, Coinbase has taken legal action in a US federal court to force the country's securities regulator to give a definitive response to a petition it submitted in July. The petition sought clearer regulatory guidelines for the cryptocurrency industry in the US.

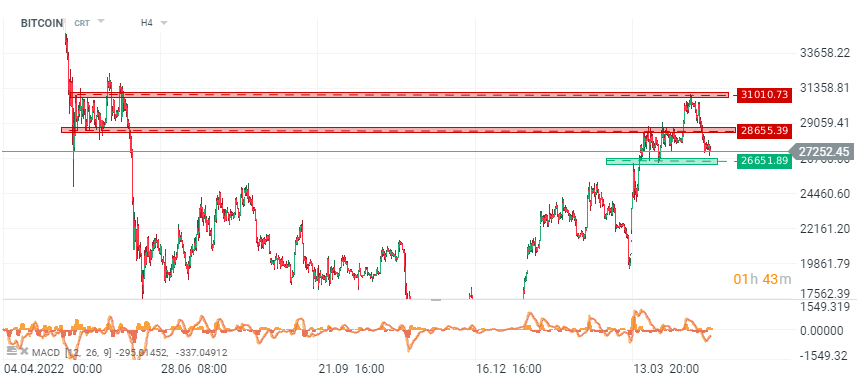

On the 4-hour timeframe, the BTC price continued to consolidate below $28,000, with the largest cryptocurrency by market capitalization trading at around $27,240, down 0.55% in the past 24 hours. BTC has already dropped by 13% from its recent highs of $31000. The price broke through the key support level around $28,600, indicating a bearish trend in the short term. Currently, the price is at the equilibrium level of the last consolidation range, indicating that the market is in a state of indecision. However, further price action downwards is expected, with the next resistance level likely to be at $26,650. This level acted as a support in the past. Overall, the short-term trend for Bitcoin appears bearish and traders should exercise caution when taking long positions. It is essential to keep an eye on any major news events or developments in the cryptocurrency space that may impact the price of Bitcoin.

On the 4-hour timeframe, the BTC price continued to consolidate below $28,000, with the largest cryptocurrency by market capitalization trading at around $27,240, down 0.55% in the past 24 hours. BTC has already dropped by 13% from its recent highs of $31000. The price broke through the key support level around $28,600, indicating a bearish trend in the short term. Currently, the price is at the equilibrium level of the last consolidation range, indicating that the market is in a state of indecision. However, further price action downwards is expected, with the next resistance level likely to be at $26,650. This level acted as a support in the past. Overall, the short-term trend for Bitcoin appears bearish and traders should exercise caution when taking long positions. It is essential to keep an eye on any major news events or developments in the cryptocurrency space that may impact the price of Bitcoin.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?