While stocks in Europe and the United States managed to recover somewhat from last week's declines, indices from China continue to underperfom. Chinese index CHNComp took a hit following the release of the lacklustre monthly data for August from the country.

-

Retail sales: 2.5% YoY vs 7.2% YoY expected

-

Industrial production: 5.3% YoY vs 5.8% YoY expected

-

Urban investments: 8.9% YoY vs 9.2% YoY expected

While it was expected that data for August may be a bit softer due to reintroduction of pandemic restrictions in some regions as well as weaker reading of PMI indices, a massive miss in the retail sales data caught markets off guard.

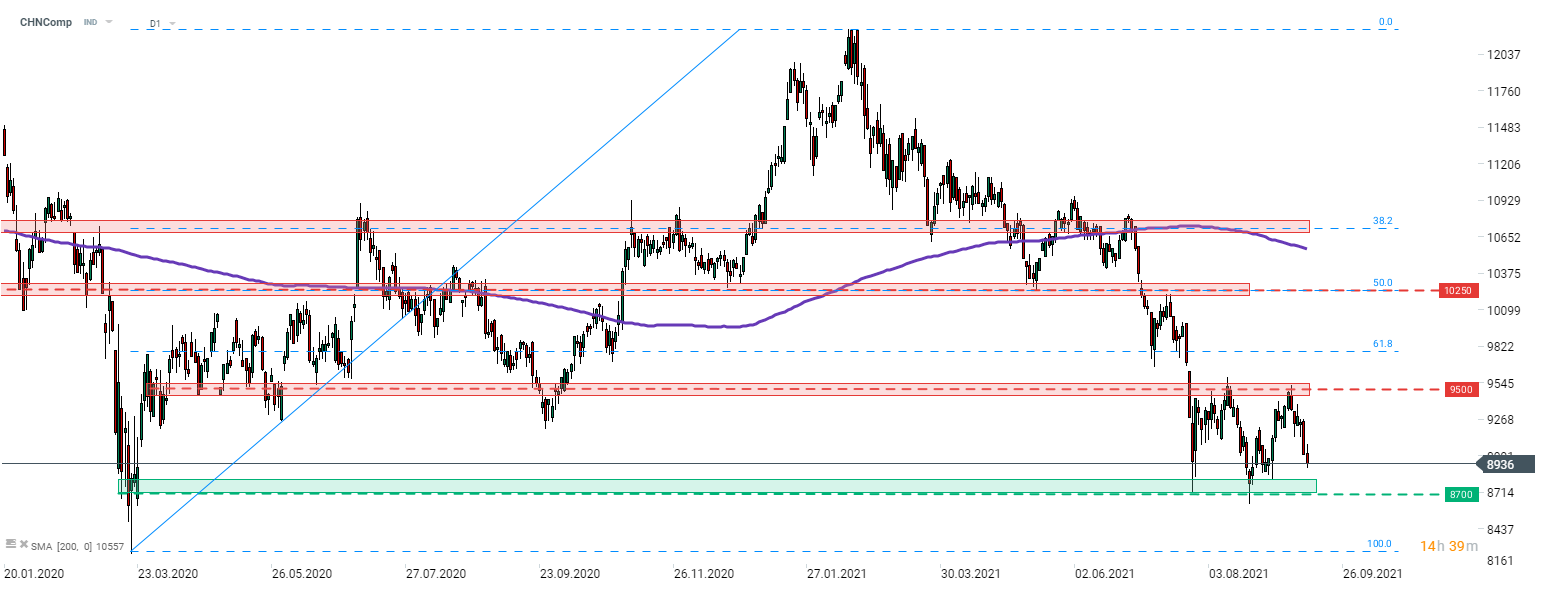

Taking a look at the index from a technical point of view, we can see that CHNComp continues pullback launched after a failed attempt of breaking above the 9,500 pts resistance. Index is closing in on the support zone ranging above 8,700 pts mark and serving as the lower limit of a current trading range. Note that downtrend structure has not been broken on the index yet therefore traders should be aware of a possible downside breakout from the trading range.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%