- Ethereum loses 4% falling below EMA50; Ethereum ETFs inflows remain below Bitcoin ETFs

- Ethereum Foundation plans to focus on privacy, while ConsenSys partnership with SWIFT to focus on new ISO20022 standard

- Chances for further US rate cuts are rising, potentially supporting ETH in the medium-term

- Ethereum loses 4% falling below EMA50; Ethereum ETFs inflows remain below Bitcoin ETFs

- Ethereum Foundation plans to focus on privacy, while ConsenSys partnership with SWIFT to focus on new ISO20022 standard

- Chances for further US rate cuts are rising, potentially supporting ETH in the medium-term

Ethereum declines over 4% today, pressured by a stronger U.S. dollar, cooling momentum in Bitcoin, and slightly more cautious sentiment across U.S. equity markets. The world’s second-largest cryptocurrency could resume its uptrend if gold and Bitcoin lose momentum again, prompting a rotation back into riskier assets amid growing expectations of U.S. rate cuts and a still “reasonable” hope for a soft economic landing. Unlike BTC, Ethereum also offers a staking option, which could attract capital in a lower-yield and lower-rate environment.

Ethereum co-founder Joe Lubin announced on Bloomberg Crypto a partnership between ConsenSys and SWIFT to develop a shared blockchain-based ledger. The system will integrate the new ISO 20022 messaging standard, which replaces SWIFT’s legacy infrastructure, with the Ethereum blockchain, potentially increasing ETH’s utility in transactions.

Meanwhile, the Ethereum Foundation revealed the creation of a 47-member team dedicated to improving blockchain privacy — including private transactions and identity solutions. ETF data shows a sharp contrast in fund flows: Bitcoin ETFs attracted over $440 million yesterday, compared with just $67.4 million for Ethereum-based funds. While BlackRock’s ETHA recorded net inflows of $147 million, both Fidelity’s FETH and Grayscale’s ETHE posted outflows of $63.1 million and $16.7 million, respectively.

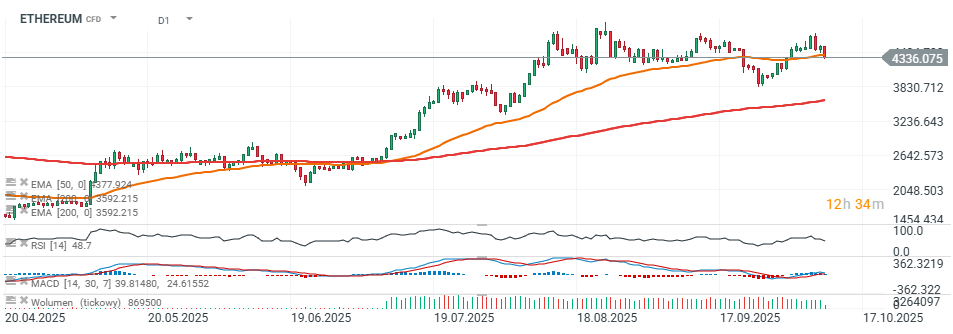

Ethereum (D1 interval)

ETH prices have fallen below the 50-day exponential moving average (EMA) near $4,370. The RSI hovers around 50, suggesting an open setup for both upward and downward moves. However, both RSI and MACD have been trending lower since July, indicating waning buying momentum near all-time highs.

Source: xStation5

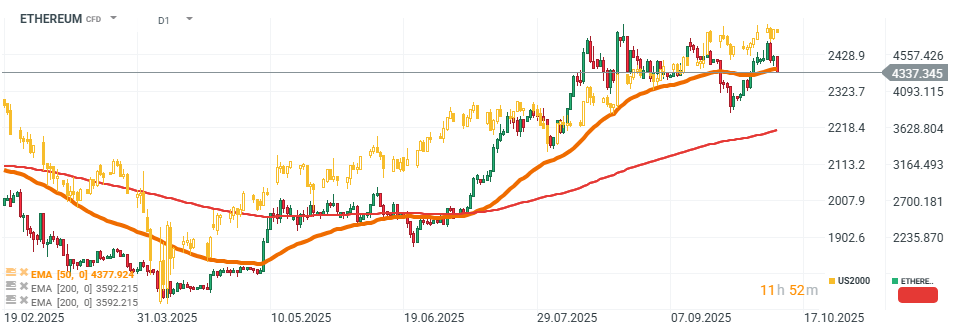

In recent weeks, Ethereum has mirrored the performance of the small-cap Russell 2000 index, which tracks U.S. companies more sensitive to interest rate changes. The chart shows a “cup and handle” formation, a bullish continuation pattern that often precedes an upside breakout. CME FedWatch data currently points to a nearly 96% probability of another 25 bp rate cut at the Fed’s October 29 meeting, and an 82% likelihood of another cut in December.

Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks