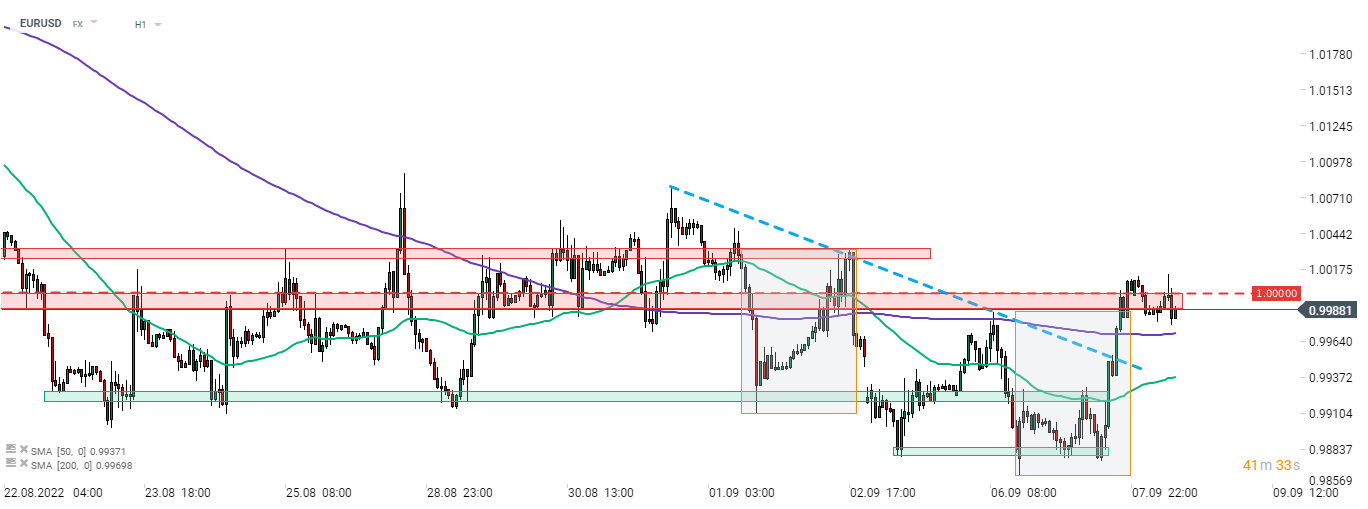

Thanks to the overall improvement in risk moods, EURUSD launched an attempt to return back above parity level. The pair is testing the 1.00 area this morning but so far has been unable to deliver a break above. However, the big event of the day for the pair - ECB rate decision - is still ahead of us.

European Central Bank is expected to announce a 75 basis point rate hike today at 1:15 pm BST. A move bigger than that is highly unlikely therefore if any surprise occurs, it would likely be a dovish one. This is especially true given that ECB hinted it will not provide a clear forward guidance and instead make decisions on a meeting-by-meeting basis. However, press conference of ECB President Lagarde at 1:45 pm BST will be closely watched as traders will look for comments on the FX moves - EURUSD still traded above 1.00 during last ECB meeting and some ECB members expressed their discontent with recent euro underperformance.

A look at EURUSD chart at H1 interval, we can see that the pair tried to make a move above 1.00 resistance zone but failed to do so. The pair broke above the downward trendline and the upper limit of the local market geometry but failed to catch a bid later on as market seems to be in wait-and-see mode ahead of ECB decision. Should a pullback occur, a near-term support can be found at the 200-hour moving average (purple line).

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)