EUR is the worst performing major currency today. While it was Japanese yen, who was top laggard during the Asia-Pacific session, euro took a big hit following release of dismal flash PMI data for June from Europe and is now underperforming against all other G10 currencies. Flash PMI data from France, Germany and euro area came in below market expectations.

While weaker outlook for France economy can be blamed on uncertainty relating to the upcoming parliamentary elections, disappointment in German PMIs is somewhat puzzling as one could expect that big event like Euro 2024 football championship would at least brighten the outlook for country's services sector.

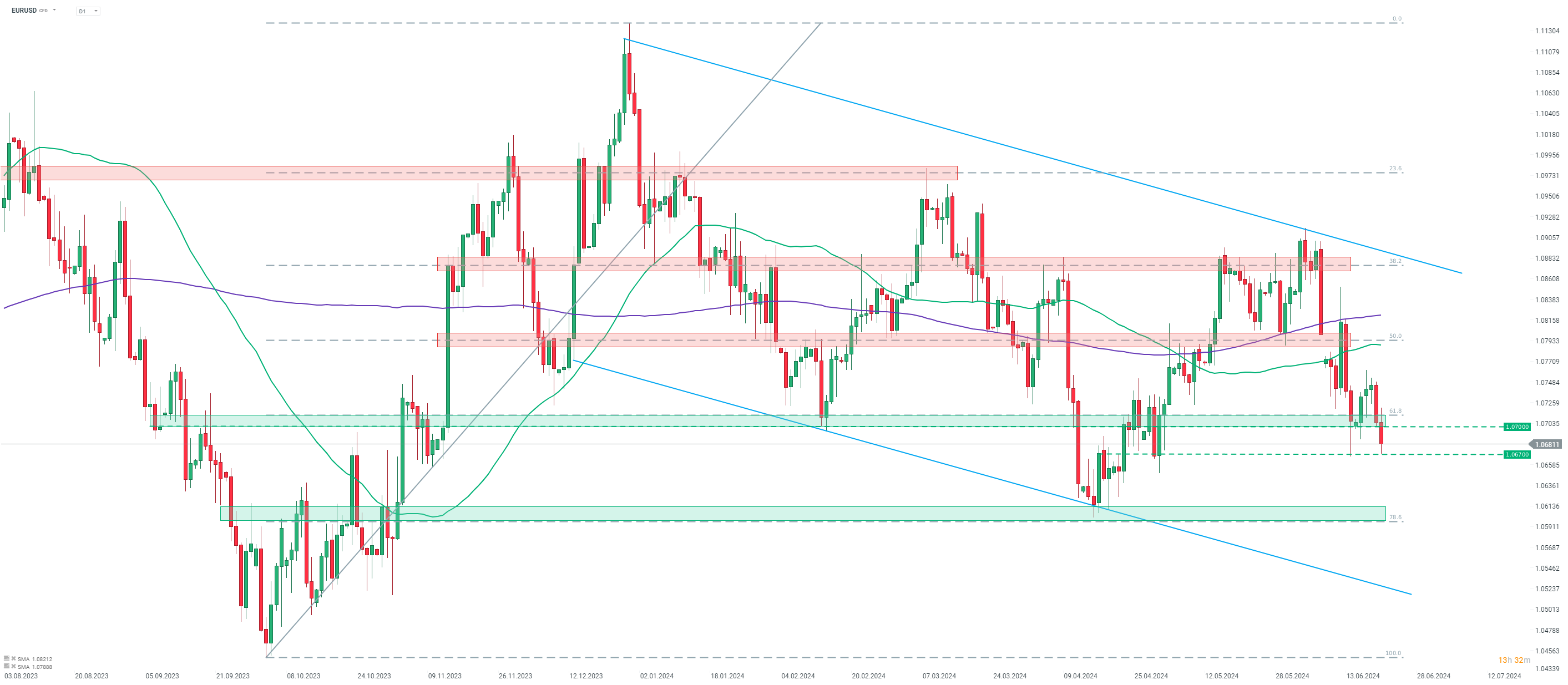

Taking a look at EURUSD chart at D1 interval, we can see that the pair has been trading in a wide downward channel since the beginning of 2024. Pair made a failed attempt at breaking above the upper limit of the channel at the beginning of June and has started to pull back. Today's post-PMI weakness plays into the overall technical picture, with the pair dropping below 61.8% retracement of the upward move launched in Q4 2023. Daily low today was reached near 1.0670 - a level marked with previous price reactions. However, should we see the pair deepen declines, the next support levels to watch are 78.6% retracement (1.06 area) and the lower limit of the channel (currently at 1.0525). Pair may see some additional volatility around 2:45 pm BST today, when flash US PMIs for June are released.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)