EURUSD is having a big week ahead. The pair will have plenty of chances and opportunities to move on including FOMC minutes (Wednesday, 7:00 pm GMT), ECB minutes (Thursday, 12:30 pm GMT) as well as flash PMIs for November from Europe and the United States (Wednesday). Policy statement from the last Fed meeting was quite dovish but was followed by a very hawkish press conference from Fed Chair Powell. Latest ECB meeting saw the introduction of changes to the TLTRO programme and generally was a rather hawkish one. While it won't be reflected in minutes, it should be noted that German PPI inflation decelerated significantly in October, boosting hopes that inflation has already peaked in Europe's largest economy.

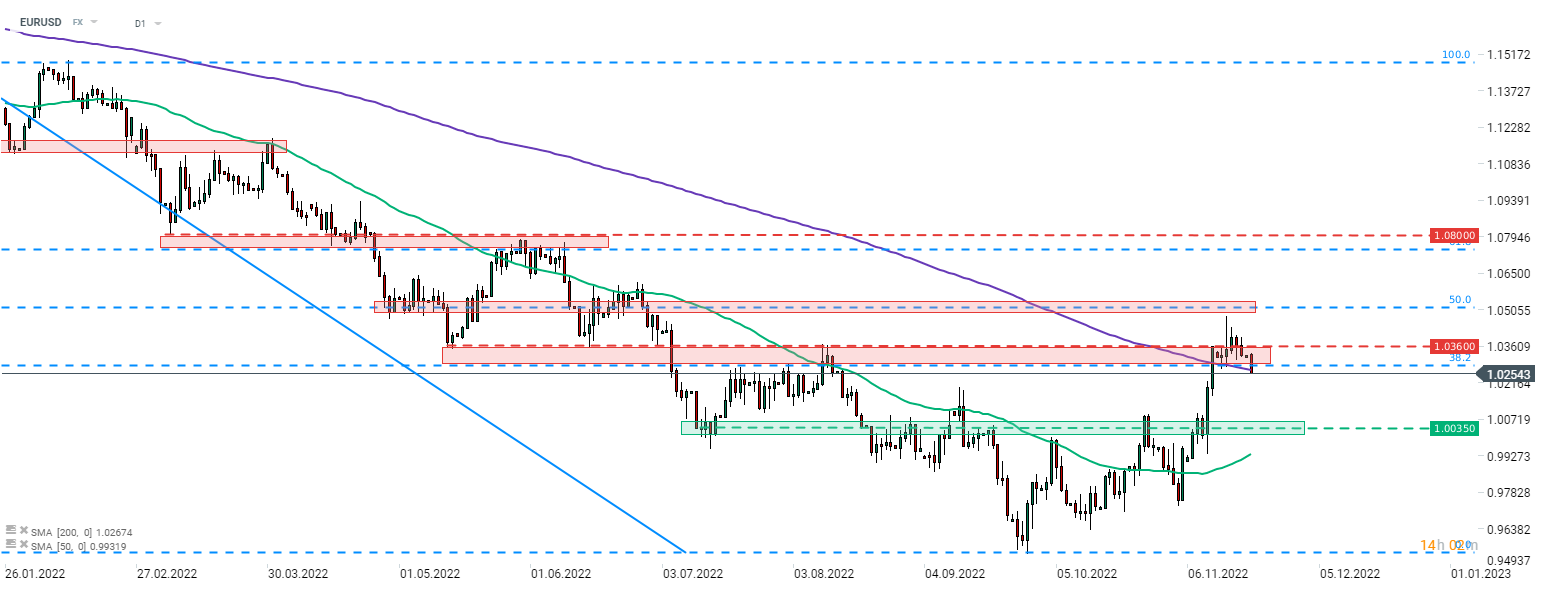

Taking a look at EURUSD, we can see that the pair continues to pull back after peaking slightly below 1.05 handle last week. Main currency pair broke back below the price zone ranging between 38.2% retracement of the downward move launched in mid-January 2022 and 1.0360 handle, and is making a break below the 200-session moving average (purple line) this morning. Much lower-than-expected PPI reading from Germany signals that ECB's tightening cycle may end sooner.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts