EURUSD seems to start a correction triggered by yesterday's publication of the Fed's minutes. Even tough, investors continue to maintain a base scenario of starting cuts as early as May and no further interest rate hikes until then. Therefore, assuming a safe scenario without a recession, the US dollar may continue to be under pressure. Nevertheless, recent statements by FOMC members clearly aim to cool the positive sentiment among investors. Bankers point out that the end of the fight against inflation is not yet close, and the Fed itself is not sure if it has done enough to combat inflation. Core inflation, excluding housing prices, remains too high, which is a problem in the business sector. After yesterday's Fed minutes, expectations regarding Fed interest rates have changed little.

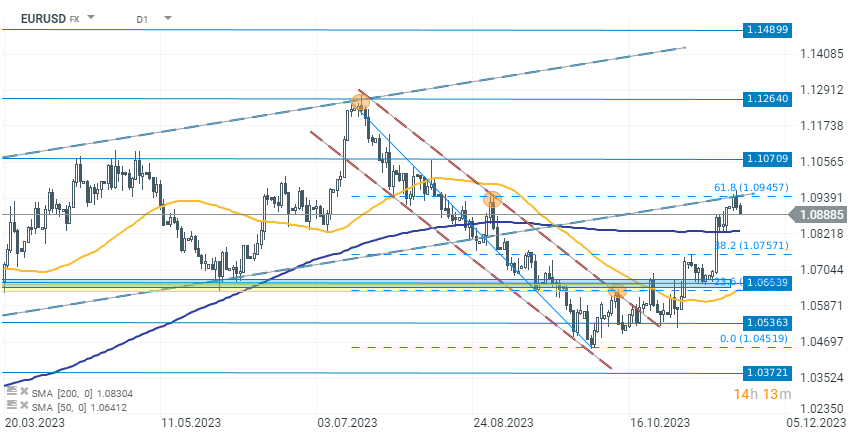

Looking at the EURUSD chart from a technical analysis perspective, the rate is again in another key zone. The EURUSD pair reacted with declines after encountering resistance at the 61.8% Fibonacci retracement level, which coincided with the lower limit of the recent upward channel. EURUSD is noted today as fairly flat. In case of increased downward pressure, the rate might retest the area around levels 1.0828, where the 200-session average is located, which has recently been an effective level of support. In case of continuation of the current trend and an upward breakout at the current level of resistance, we might even see an attempt to test 1.1070 - levels at which gains were halted in the first part of this year.

Source: xStation 5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts