GBP is making the headlines today due to a massive crash of the currency. The British pound has been in freefall since Friday, following the announcement of new expansionary fiscal measures, including the largest tax cuts in decades. While measures are aimed at stimulating economic growth, there are concerns about financing for it as well as its impact on inflation. GBPUSD experienced a flash crash this morning, dropping as much as 4.5% at one point of the Asian session. The pair dropped below 1.0350, reaching the lowest level on the record. Moves on other GBP-tied FX pairs were also massive. However, GBP bounced off the daily lows and in some cases, like for example GBPJPY, the downward move was almost completely erased.

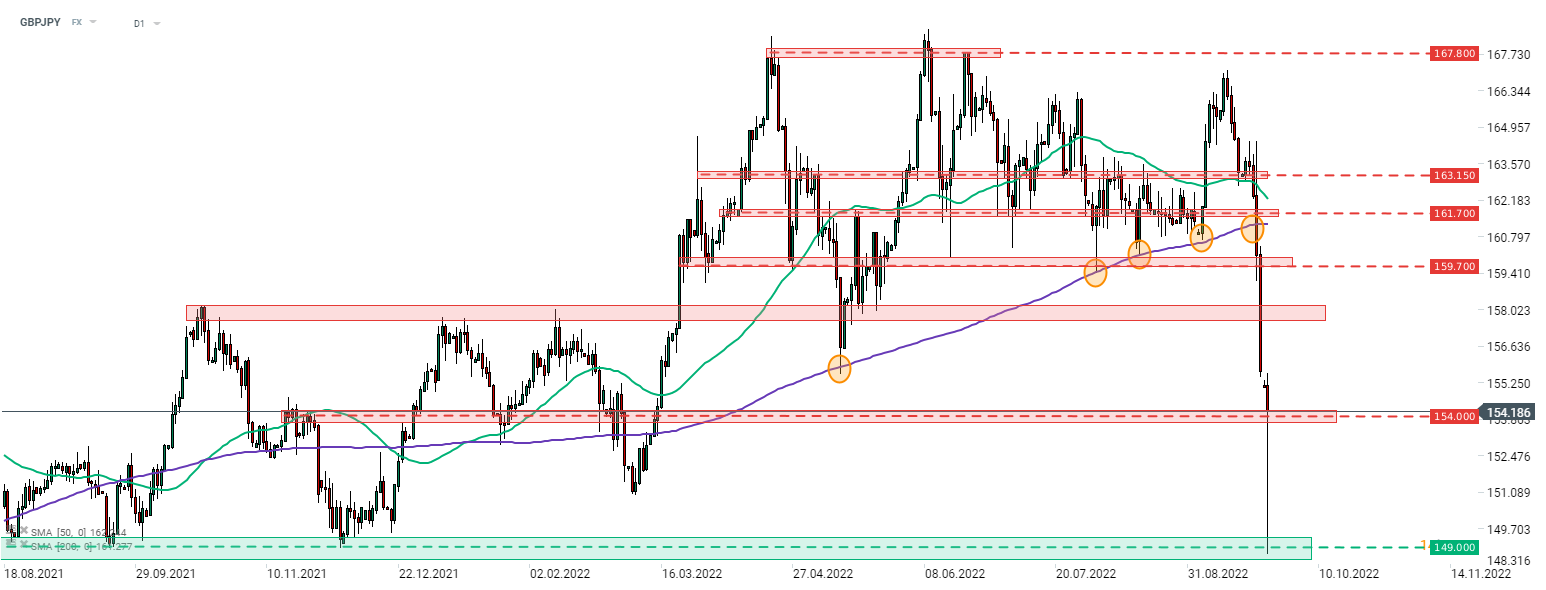

Taking a look at GBPJPY chart at D1 interval, we can see that downward move on the pair accelerated on Thursday, September 22 in the aftermath of BoJ FX intervention and BoE less-hawkish-than-expected monetary policy decision. Pair finally broke below the 200-session moving average - an important support - following a few failed attempts to do so (orange circles). Sell-off accelerated afterwards and was fuelled further by the fiscal policy announcement on Friday. The pair slumped this morning and tested 149.00 support zone, the lowest level since late-July 2021. However, bulls managed to halt declines there and launched a strong recovery. Currently, the pair is making a break back above the 154.00 price zone, erasing around 80% of today's drop. Should the pair hold above this area until the end of the day, a major pin bar would be painted at an important mid-term price zone - a bullish technical signal.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)