Jerome Powell poured cold water onto those who hoped for a pivot. Fed Chair said during a press conference yesterday that it is very premature to think about slowing rate hikes and that the ultimate level of interest rates may be higher than previously anticipated. Message sent by Powell was very hawkish and markets reacted accordingly - USD gained while indices and precious metals moved lower.

Policy decisions from another major central bank will be announced today - Bank of England at 12:00 pm GMT. Bank is expected to deliver a 75 basis point rate hike, putting the main interest rate at 3.00%. However, when it comes to the Bank of England, it should be noted that the previous meeting took place a day before Liz Truss presented its disastrous tax cut plan that lacked financing. A lot has changed since then - BoE delayed QT and relaunched QE while Conservative Party changed UK Prime Minister. While BoE sure has a lot of questions to answer, investors may not get all the answers they want. As the medium-term budget presentation was delayed until mid-November, it looks like the Bank of England will refrain from making any major statements on the future outlook for the UK economy until then. Nevertheless, GBP is likely to be volatile around announcement time.

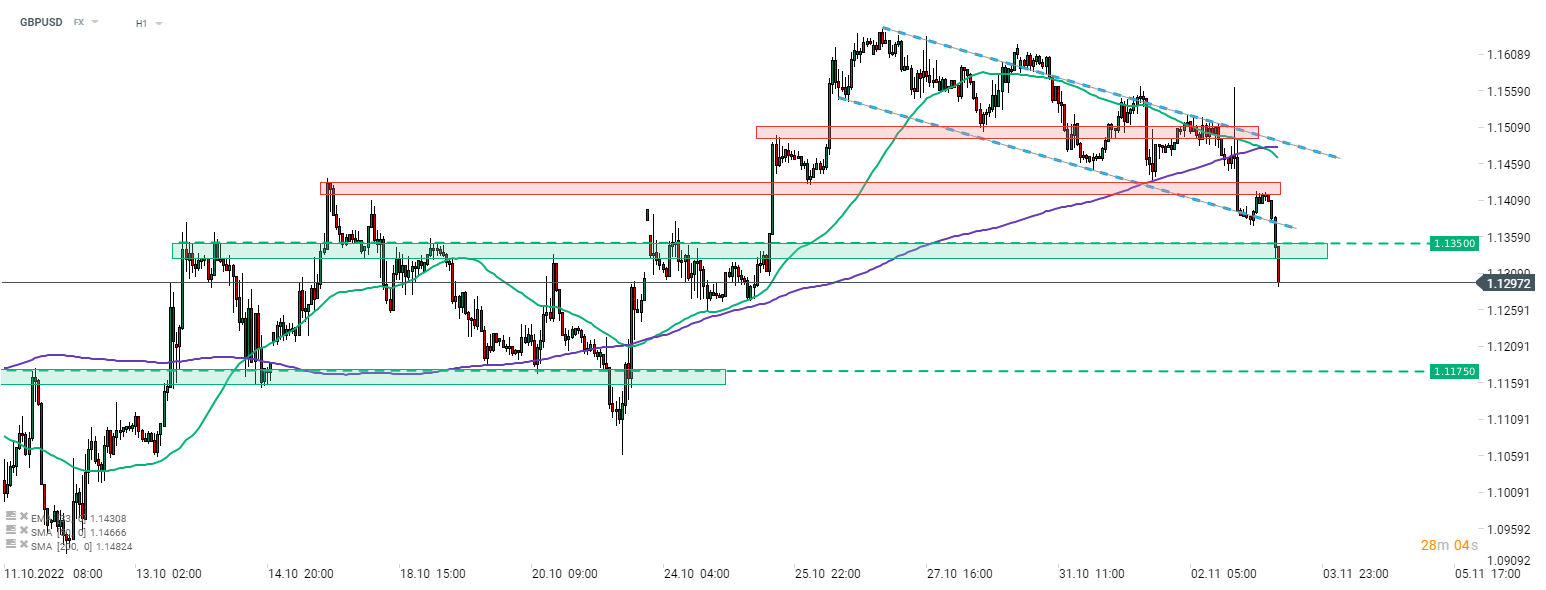

Taking a look at GBPUSD chart at H1 interval, we can see the pair plunged below the lower limit of a short-term downward channel this morning and the downward move accelerated afterwards. GBPUSD broke below the 1.1350 support zone and is now testing the 1.1300 psychological area. Should bears manage to clear it, the next major support zone to watch can be found ranging below 1.1175.

Source: xStation5

Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes