US natural gas prices (NATGAS) launched a new week's trade with a big bearish price gap. NATGAS is trading around 6% lower on the day. Improved weather forecasts for the United States can be named as a reason. New weekly forecasts suggest that temperatures will be above-average for this period of the year in the majority of western US states. Prices are also dropping in Europe where Dutch TTF benchmark is dropping around 14%. A story to watch in case of natural gas is the EU price cap. EU officials are now discussing price cap of around €180-190, down from earlier suggested €300 per MWh. However, some countries are opposed to putting the cap below €200 per MWh. Nevertheless, even a €180 cap would be above market price that EU countries are currently paying for gas and therefore should not have much of an impact on supply.

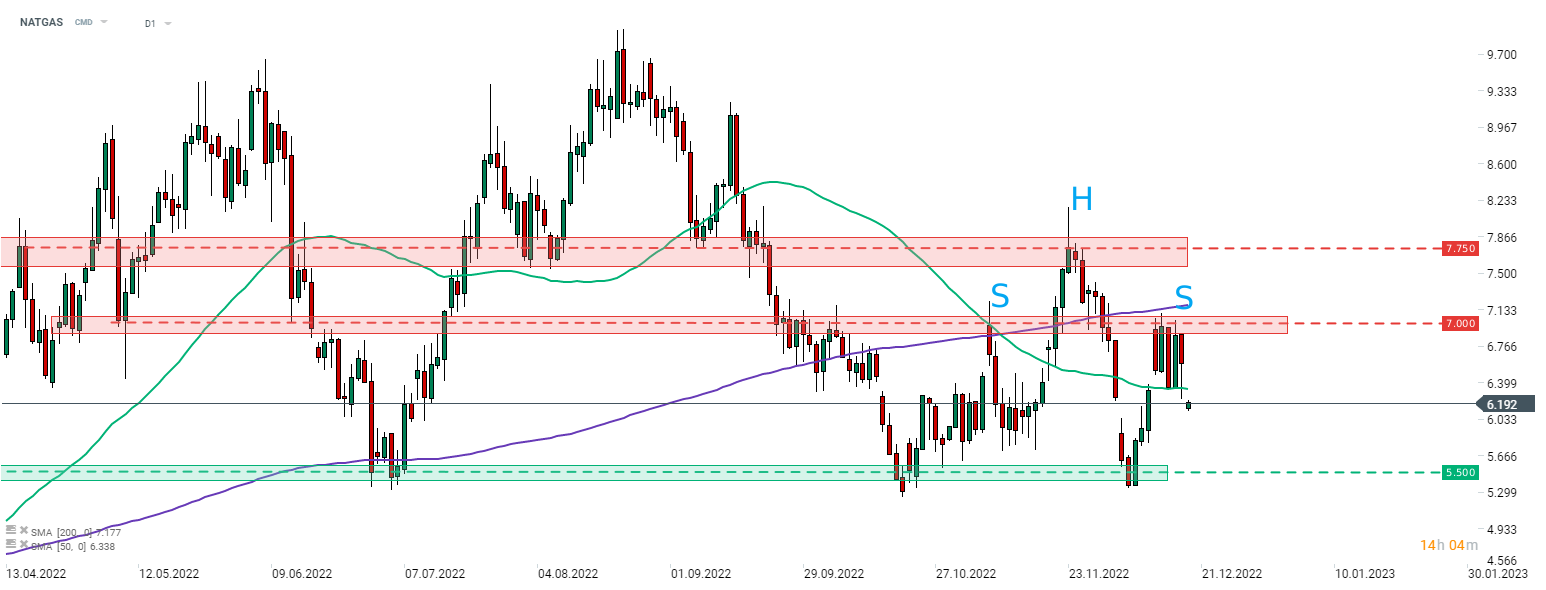

Taking a look at NATGAS chart at D1 interval, we can see that price launched today's trading with big bearish price cap and dropped below 50-session moving average (green line). Overall, price is pulling back from the $7.00 resistance zone. The nearest important support zone to watch can be found in the $5.50 area. Note that $5.50 area also marked neckline of a potential head and shoulders pattern.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74