Omicron and uncertainty related to its impact on health and economy remains a source of concern. There still seems to be no consensus among scientists on whether current vaccines protect against this variant of coronavirus or not. While some countries in Europe has started to tighten restrictions in order to combat spread of a new variant, the Netherlands went a step further and imposed a full nationwide lockdown.

Dutch Prime Minister Rutte announced that non-essential shops, restaurants and bars will be closed starting from Sunday, December 19 until Friday, January 14. Schools and universities will remain closed until Sunday, January 9. Households will be allowed to host only 2 visitors during lockdown with the limit increased to 4 for Christmas and New Year's Eve. There is a risk that such a move from the Dutch authorities will encourage other European leaders to follow. However, German and UK authorities have already ruled out imposing a lockdown for Christmas.

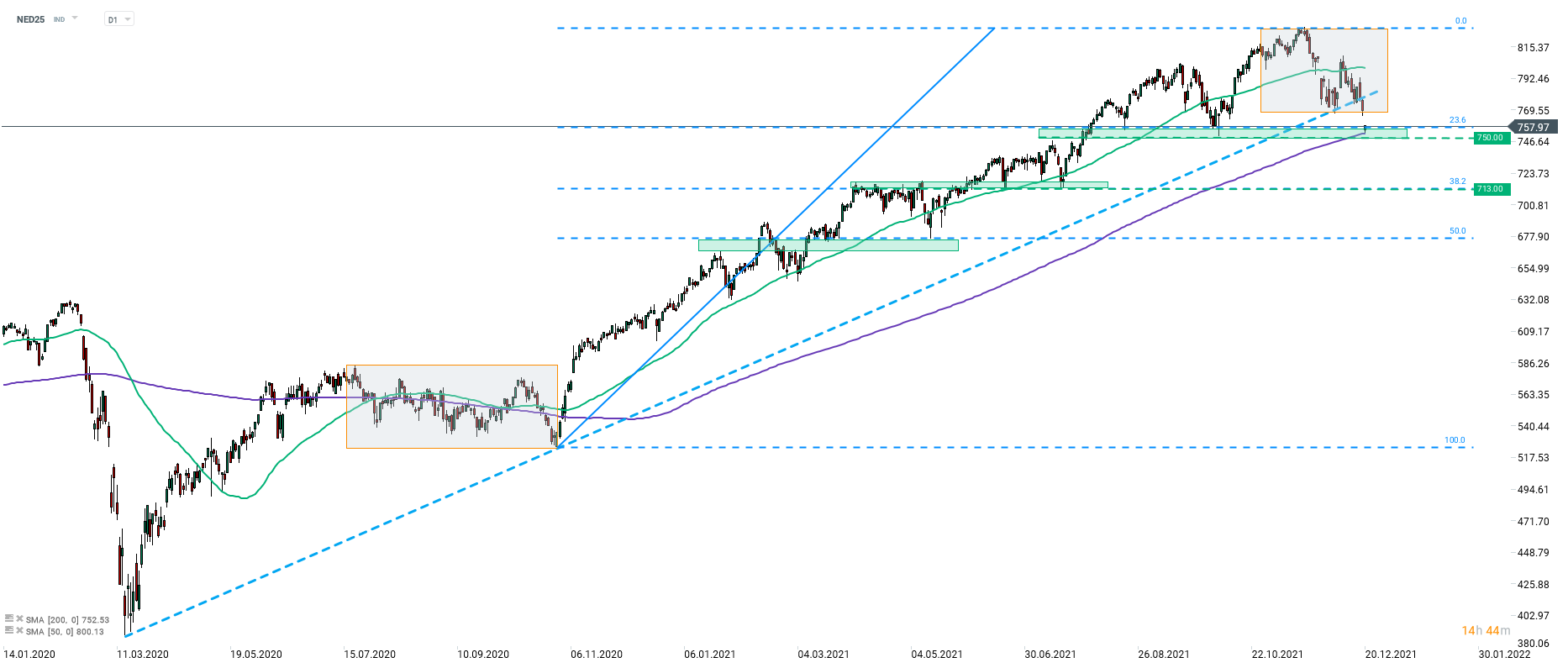

Nevertheless, there is a feeling of nervousness in the markets. Major European stock market indices plunged at the beginning of a new week. However, it should be said that delay to US infrastructure bill talks is also playing a role here. Taking a look at the Dutch AEX (NED25), we can see that the index launched today's trading with a big bearish price gap. Price tested short-term support zone ranging between 750.00 handle and 23.6% retracement of the upward impulse launched after 2020 US presidential elections.The area is also strengthened by the 200-session moving average (purple line). From a technical point of view, outlook is somewhat bearish after the index dropped below the lower limit of the market geometry. The next support zone to watch can be found near the 38.2% retracement (713.00 area).

Source: xStation5

Source: xStation5

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022

US Raises Tariffs to 15%