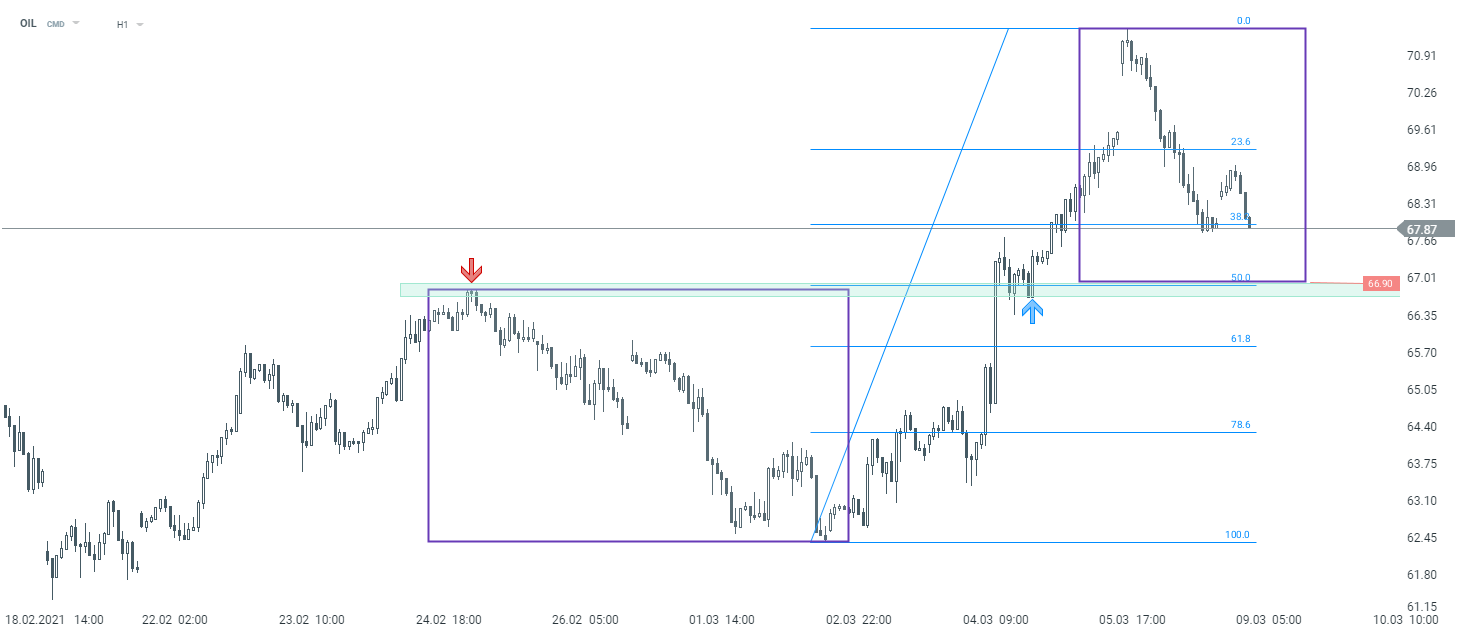

In spite of Brent (OIL) launching the week with a big bullish gap, buyers were unable to maintain momentum and price started to pull back. OIL erased 2% gain to finish Monday's trading more than 2% below Friday's closing price. Price tried to recover during today's Asian session but those gains were erased as well and Brent is now testing 38.2% retracement of the upward impulse started last week. In case this support is breached, we cannot rule out a move towards the $66.90 area, where 50% retracement and lower limit of the Overbalance structure are located. Breaking below the $66.90 area would hint at short-term trend reversal.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74