Oil prices took a steep dive yesterday in the afternoon, with Brent and WTI dropping more than 3% over 2 hours. There was no clear trigger for the move. Fundamental background for lower oil prices is that rising Delta variant cases will lead to more restrictions and thus have a negative impact on oil demand. Recent news flow from Asia-Pacfic region, especially China and Australia, has been worrying. China imposed restrictions on traveling, parts of Australia have been in lockdown for weeks while hospitals in Japan are severely overwhelmed and remaining bed capacity is extremely low. Question now is whether the virus leads to a similar situation in Europe or the United States. In such case, oil prices could find themselves under even more pressure

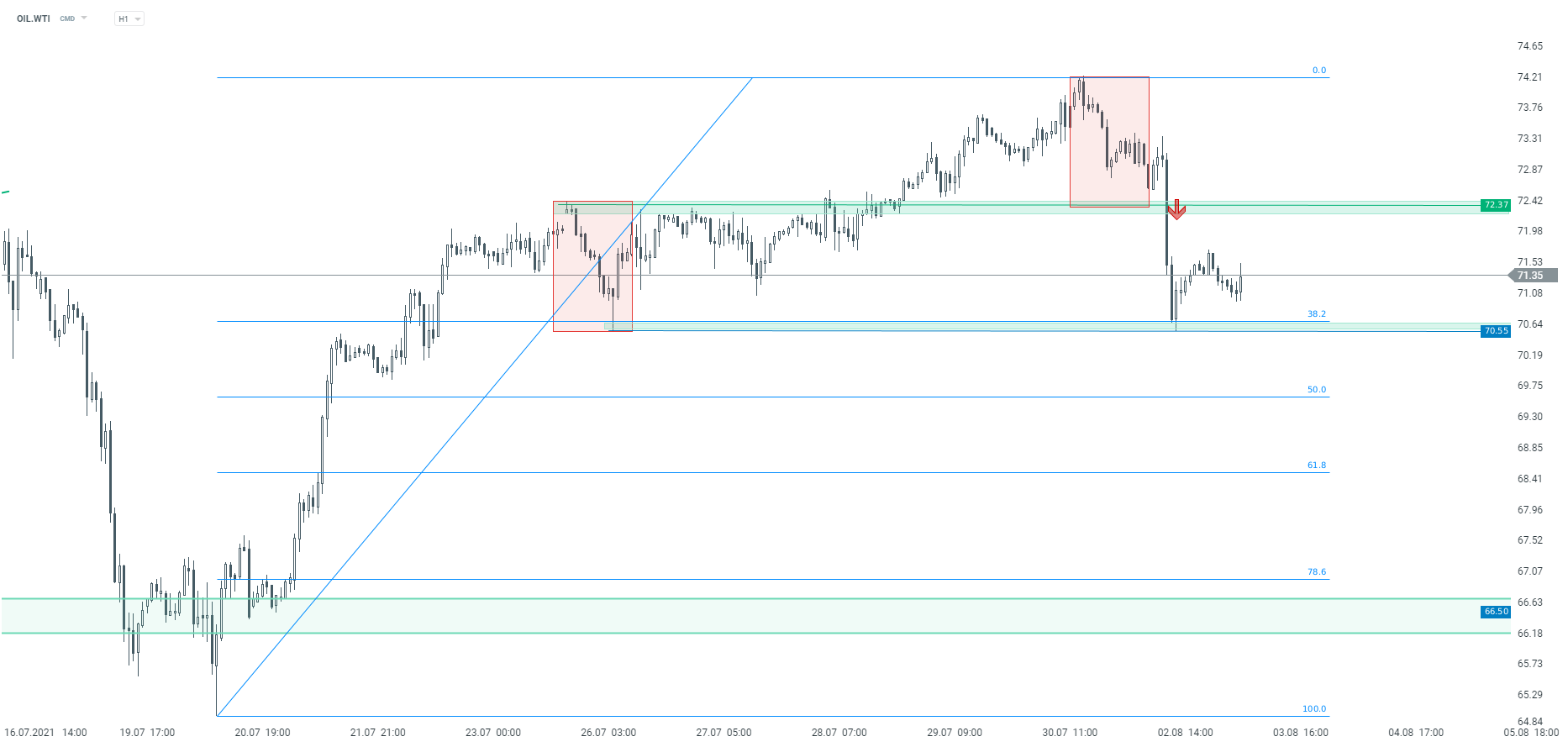

Taking a look at WTI (OIL.WTI) from a technical point of view, we can see that price plunged below an important support yesterday - $72.35 area, marked with the lower limit of market geometry and previous price reactions. Downward move was halted at 38.2% retracement of the recent upward impulse ($70.60 area) and commodity has traded sideways since. The aforementioned $72.35 zone is the near-term resistance to watch.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74