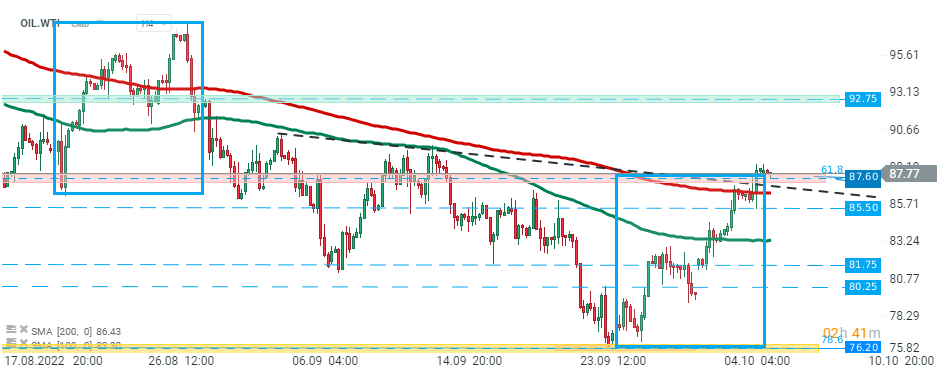

WTI crude futures traded near $88.00 per barrel on Thursday, having rallied more than 10% so far this week as OPEC+ agreed to cut output by 2 million barrels per day, the biggest output cut since the start of the pandemic. Yesterday the price broke above the major resistance zone around $87.60, which is marked with upper limit of the local 1:1 structure, downward trendline and 61.8% Fibonacci retracement of the upward wave launched in December 2021. As long as price sits above this level, upward move may accelerate towards next resistance at $92.75.

OIL.WTI, H4 interval. Source: xStation5

OIL.WTI, H4 interval. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉