Oil launched a new week higher following a cyberattack in the United States on Friday. As a result of the attack, Colonial Pipeline was forced to shut down the largest oil products pipeline on the East Coast. The US government declared a state of emergency over the matter. So far, it is unknown how long will the shutdown last as the operator is still working on restoring pipeline capacity. If the situation is not resolved quickly, upward pressure on oil and gasoline prices may intensify.

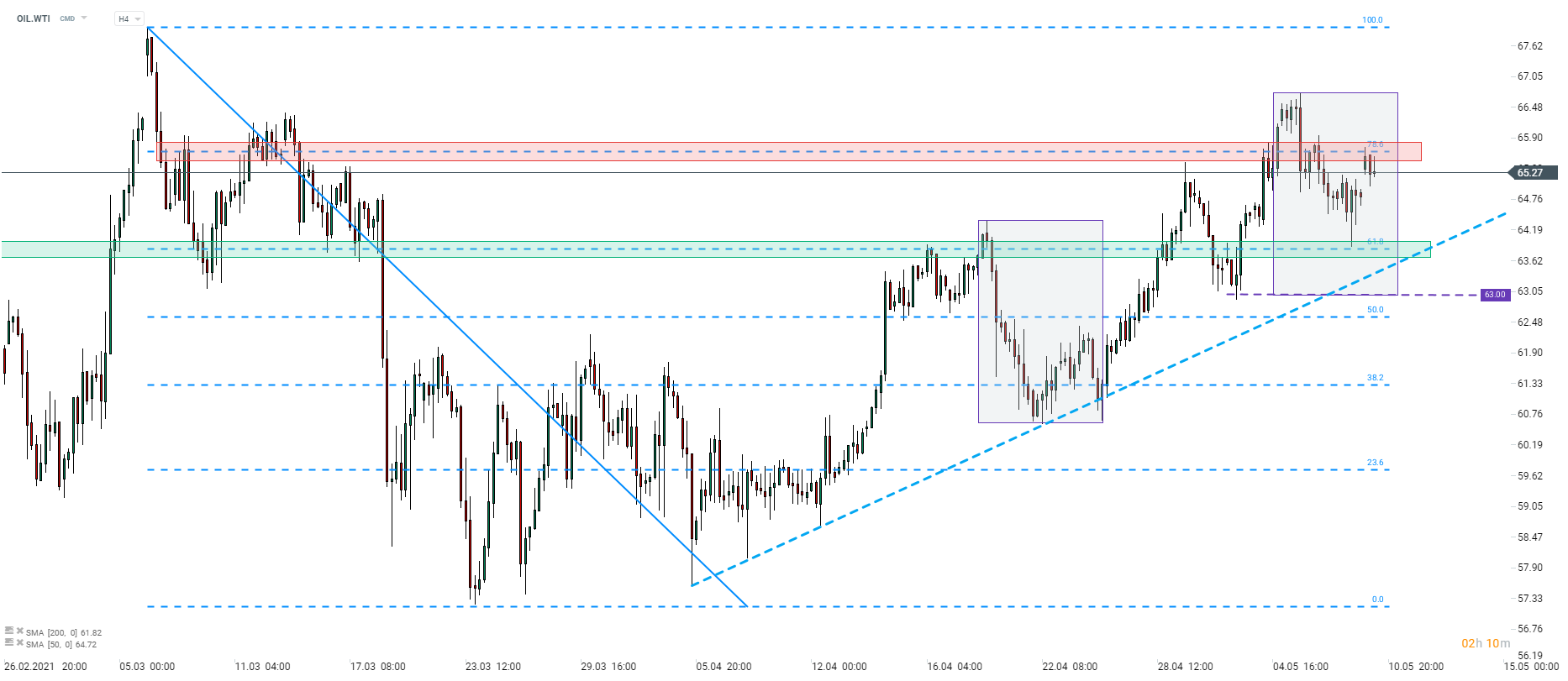

Taking a look at OIL.WTI from a technical point of view, we can see that the price launched today's trading with a bullish price gap but has later on reacted to the 78.6% retracement of the downward move launched on May 3, 2021 ($65.70). OIL.WTI started to pull back but has not managed to close the bullish gap yet. In case the ongoing pullback continues the first major support zone to watch can be found at the 61.8% retracement ($63.85) while the final support can be found at the lower limit of the Overbalance structure ($63.00).

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74