Oil is trading higher at the beginning of a potentially big week. Iranian presidential elections are scheduled for Friday, June 18. This is important with regards to ongoing nuclear talks as the United States fear that negotiations may get tougher after elections. Having said that, US negotiators will try to finalize the agreement this week. Nuclear agreement is expected to serve as a basis for lifting Iranian oil sanctions. In other news, the latest IEA report urged OPEC to boost production as high demand risks creating a large deficit in the oil market.

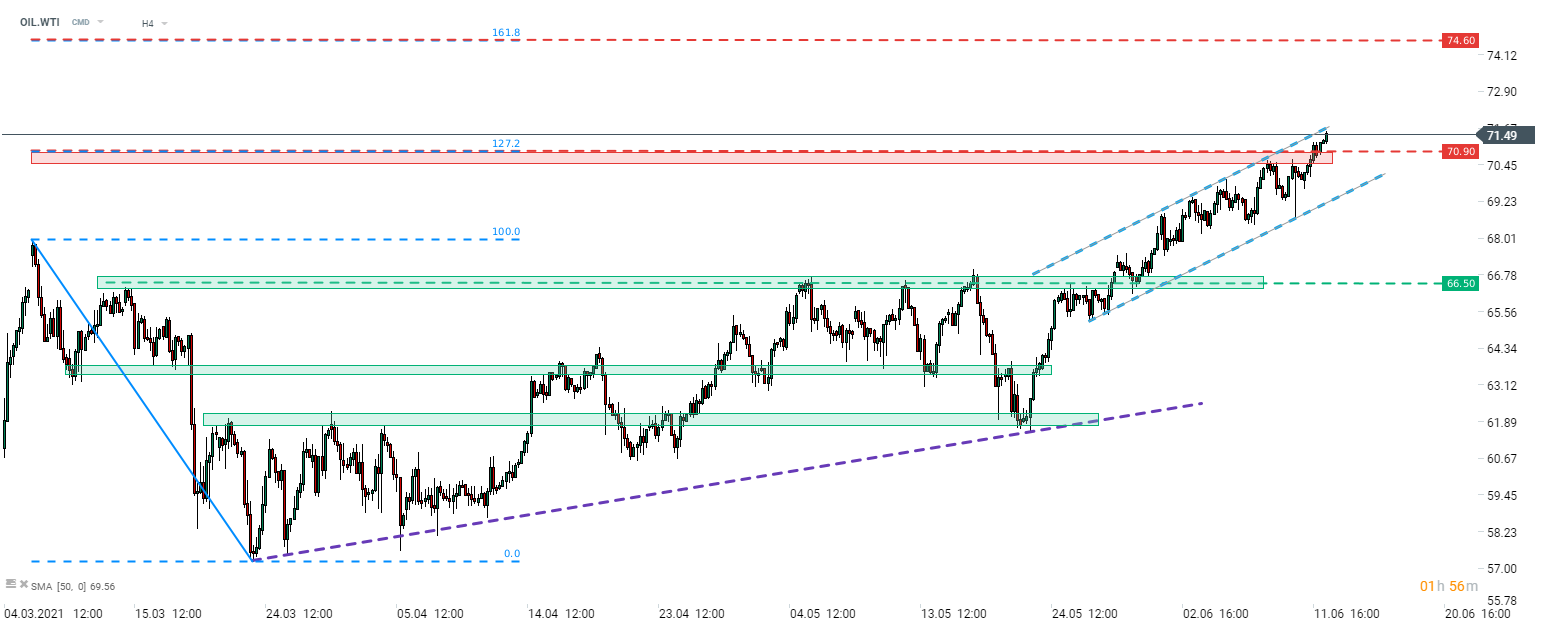

Taking a look at OIL.WTI from a technical point of view, we can see that price broke above the resistance marked with 127.2% exterior retracement of early-March correction ($70.90 area). WTI is approaching the upper limit of a steep upward channel so traders should beware of potential short-term weakness. However, if we see a break above this hurdle, the next resistance to watch can be found at 161.8% retracement in the $74.60 area.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74