Rally on the oil market was halted at the beginning of this week. Increase in risk aversion has taken a toll on equity markets as well as oil prices. There was also some fundamental oil-specific news that can explain lacklustre performance of crude this week. Namely, OPEC has lowered its global oil demand growth forecast for this year in its monthly report. Group of oil producers expects daily oil demand to grow by 5.8 million barrels in 2021, to 96.6 million barrels. Previous forecast pointed to an increase of 5.96 million barrels. At the same time, OPEC has boosted forecasts for its own production and now expects the whole cartel to pump 29.36 million barrels per day in the final quarter of the year. Note that OPEC's output stood at 27.33 million barrels per day in September therefore production in Q4 is expected to be much higher. Combination of lower demand and higher supply is generally negative for prices.

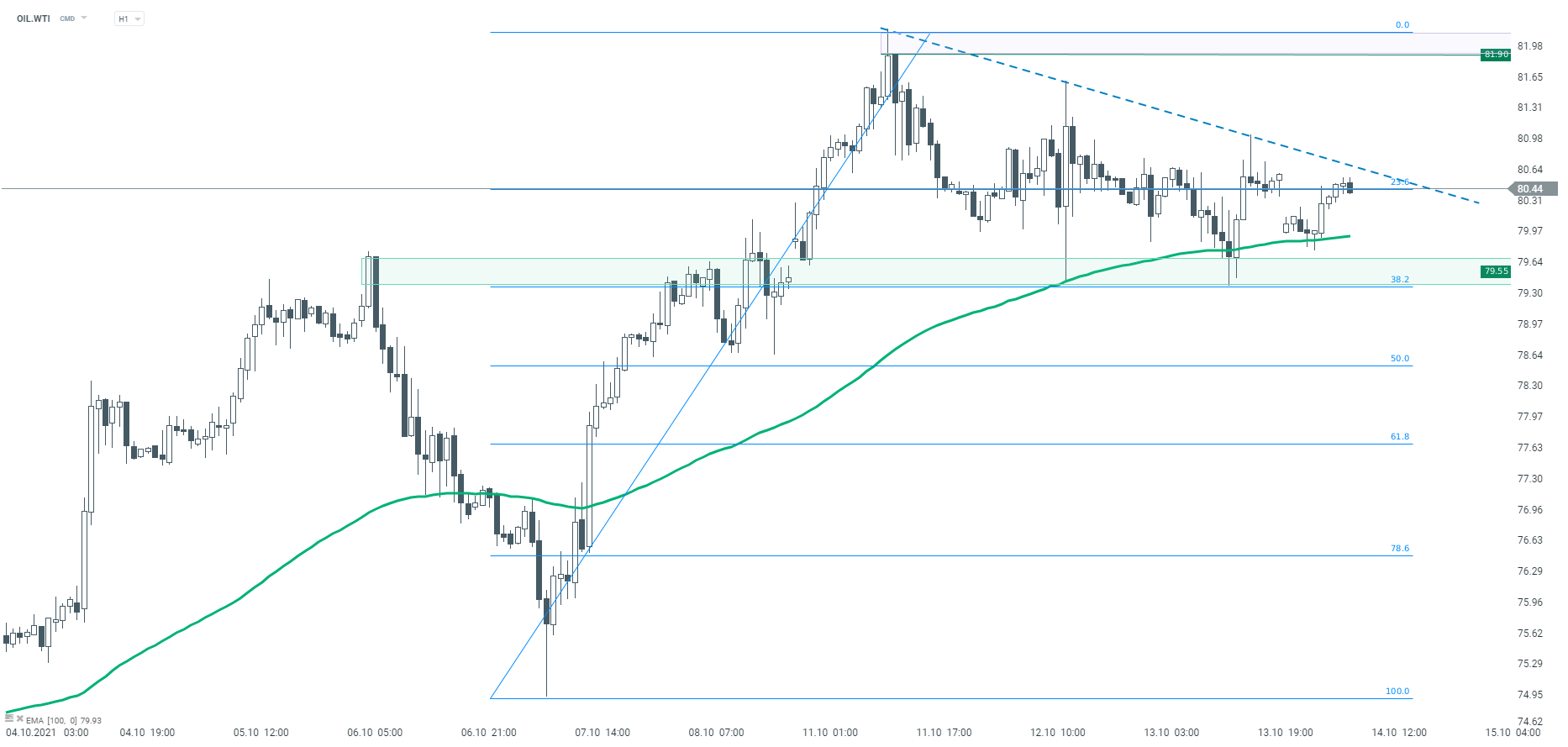

Taking a look at the WTI chart (OIL.WTI), we can see that the price has been slowly moving lower throughout the week. A downward trendline can be drawn through recent local highs. OIL.WTI is trading slightly higher today but unless bulls push the price above the aforementioned trendline, going long may be a risky play. In case of another failure to break above, a pullback may be launched with 100-period EMA (green line) in the $80.00 area being the first support to watch. Oil may become more volatile today at 4:00 pm BST when DOE report on inventories is released. API report yesterday pointed to a large 5.21 million barrel build in oil stocks, while the market expected an increase of just 0.1 million barrels.

Source: xStation5

Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook