On Wednesday, the third meeting of the US Federal Reserve (Fed) Board regarding interest rates will take place this year. Investors expect no changes in interest rates. However, market attention will focus more on Fed Chairman Jerome Powell's speech and the outlook for the rest of the year.

The past month has been quite tough for stock market investors and other risky assets. Investors' expectations have shifted toward a more hawkish approach, and strong labor market data and a rebound in inflation were further catalysts. As a result, US bond yields have climbed back toward record levels. Yields on 2-year bonds even briefly exceeded 5%.

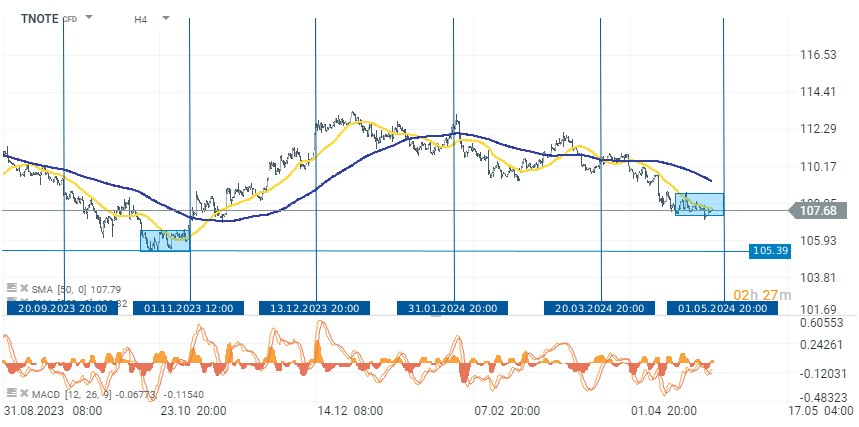

Recent sharp declines suggest that the potential for further decreases is theoretically limited. The price of the 10-year bond index contract (TNOTE) is less than 2.00% from the lows at the end of 2023. Moreover, in the current scenario, the markets are already positioned hawkishly. Thus, any softer stance by the Fed could signal a rebound. On the other hand, there is also the risk of a more hawkish stance by the Fed, which could push the TNOTE price down toward testing local lows and delay a potential rebound to the following months. However, in both cases, assuming no return to interest rate hikes, the potential range of further declines on the TNOTE contract is limited. On the chart, blue lines mark the dates of subsequent Fed decisions.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report