FOMC minutes released yesterday turned out to be a rather hawkish release. As expected, FOMC minutes strongly suggested that the balance sheet reduction should start in May. According to the document, Fed members see a $60 billion monthly cap on Treasuries and $35 billion monthly cap on mortgage-backed securities as an appropriate pace of balance sheet run-off. One interesting takeaway from yesterday's minutes release is that reportedly many Fed members want a 50 basis point rate hike in March, instead of a 25 basis point rate hike. If so, it shows that expectations of many Fed members were not too far off market expectations. Note that interest rate derivatives are currently pricing in around 210 basis points increase in US rates by the end of 2022.

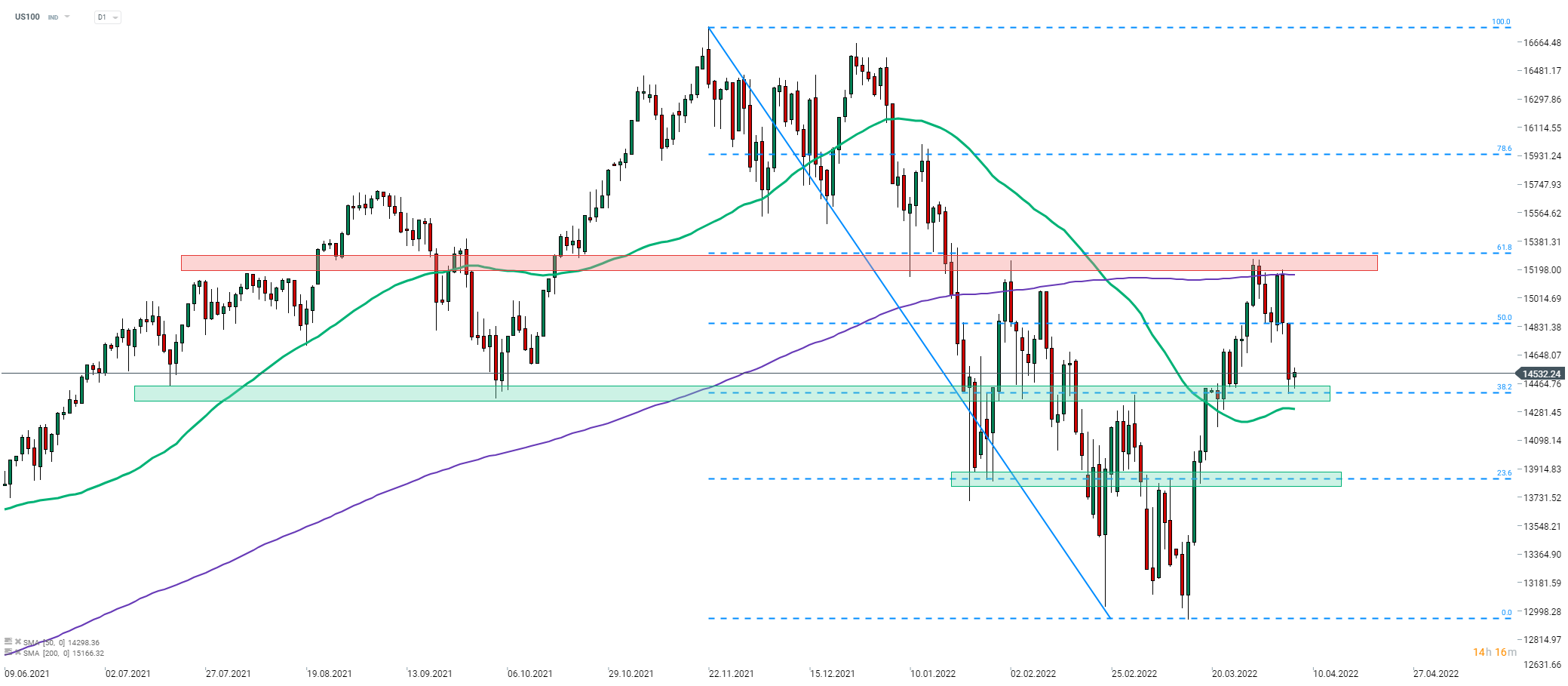

A strong hawkish message sent by FOMC minutes exerted some pressure on indices. Tech sector, which is viewed to be the most vulnerable to changes in the level of rates, took an outsized hit. Taking a look at Nasdaq-100 (US100) chart at D1 interval, we can see that the index turned lower after painting a double top pattern near the 200-session moving average (purple line). Index plunged to 38.2% retracement of a drop launched in November 2021 (14,400 pts) and thus the realized reached the textbook range of a breakout from the aforementioned pattern. A lot will now depend on the reaction of the index to the 14,400 pts area. In case of a drop below it, traders should focus on the next support at 23.6% retracement as test and recovery from this area would paint a right arm of an inverse head and shoulder pattern with neckline at 61.8% retracement.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report