Nasdaq-100 (US100) as well as other Wall Street indices have been struggling recently. Still-tense geopolitical situation in the Middle East, as well as declining market odds for the beginning of Fed rate cut cycle in the first half of this year, are putting pressure on US equity markets. Big tech companies, which were drivers of Wall Street gains in 2023 and Q1 2024 also saw their rallies ease or halt.

However, things may be about to change. We are entering a period of Wall Street earnings season, that will see release of Q1 report from US big tech companies. This is a chance for Nasdaq-100 especially. Among key Nasdaq-100 members that will report earnings this week, one can find:

- Tesla (TSLA.US) - Tuesday, after market close

- Meta Platforms (META.US) - Wednesday, after market close

- Alphabet (GOOGL.US) - Thursday, after market close

- Intel (INTC.US) - Thursday, after market close

- Microsoft (MSFT.US) - Thursday, after market close

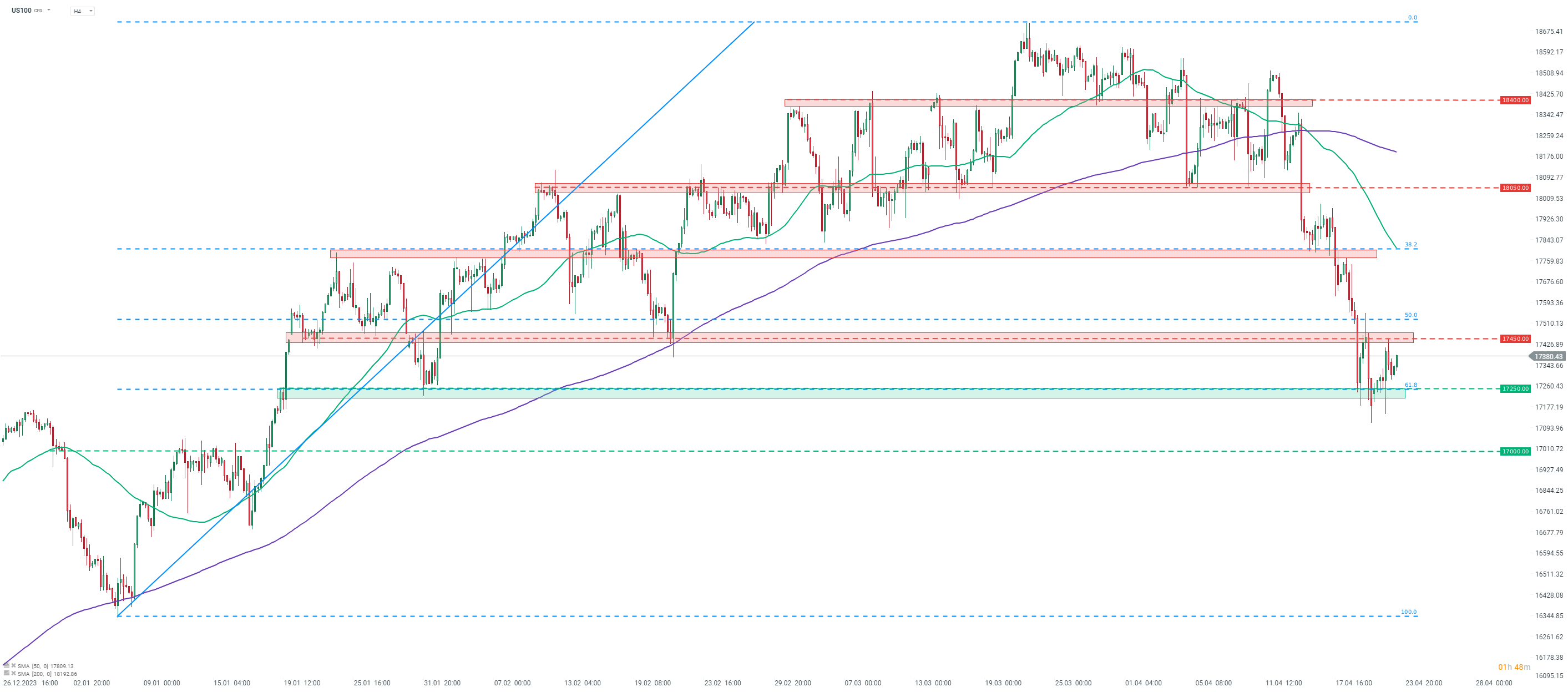

Taking a look at US100 chart at H4 interval, we can see that the index is trading around 7% below all-time highs reached at the end of March 2024. Index have been pulling back since the beginning of Q2 2024, but the downward move has been halted recently at the 61.8% retracement of the upward move launched at the beginning of January 2024. However, attempts to launch a recovery move were halted in the 17,450 pts area. Strong reports from US big tech companies may help fuel a longer-lasting recovery. On the other hand, failure to appease investors and show Q1 results that matched Q1 stock performance may trigger another leg lower in the ongoing pullback. In case the index breaks below 17,250 pts support, the next potential support can be found in the 17,000 pts area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report