The US100 closed yesterday with a loss of 1.60%, though the declines were partially reduced by the session's end. The sell-off was driven by technology and consumer companies. The biggest losers included Arm (-6.67%), Old Dominion Freight Line (-5.45%), CoStar (-5.27%), Palo Alto Networks (-4.76%), Qualcomm (-3.80%), Broadcom (-3.27%), and Meta Platforms (-3.15%).

Texas Instruments (TXN.US)

The only standout company in the index yesterday was Texas Instruments (TXN.US), which closed with a 4.01% gain, the highest from the US100 members. The semiconductor manufacturer released its quarterly report on Tuesday after the U.S. market closed. The company reported results slightly below expectations and issued cautious forecasts for Q4. The forecasted EPS is between $1.07 and $1.29, and revenues are expected to be between $3.7 and $4.0 billion, which is below analysts' expectations. However, demand for the stock was driven by solid sales to China, particularly in the automotive sector. CEO Haviv Ilan mentioned that the company is setting new sales records in China (especially for electric vehicle chips), and the outlook is promising.

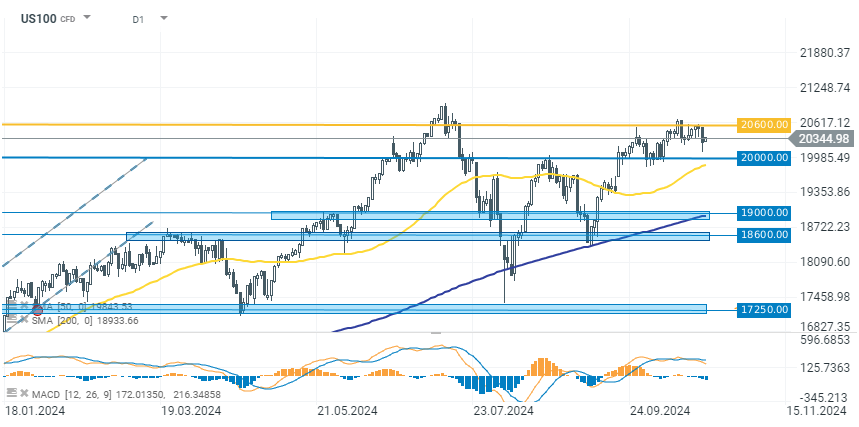

US100 (D1 interval)

Today, bulls are attempting to recover some of the losses, with US100 futures gaining 0.40% in the first part of the day. Improved sentiment is certainly supported by Tesla's (TSLA.US) strong results, which saw the stock rise as much as 12% in after-hours trading. From a technical perspective, the key support zone for the current downtrend remains at 20,000 points, while the upper resistance level is around 20,600 points.

Source: xStation 5

US500: US stocks lose momentum despite the strongest S&P 500 revenue growth in 3 years 📊

Morning wrap (20.02.2026)

Daily summary: Moderate risk, moderate declines

Blue Owl Capital: Local issue or a “Lehman moment”?