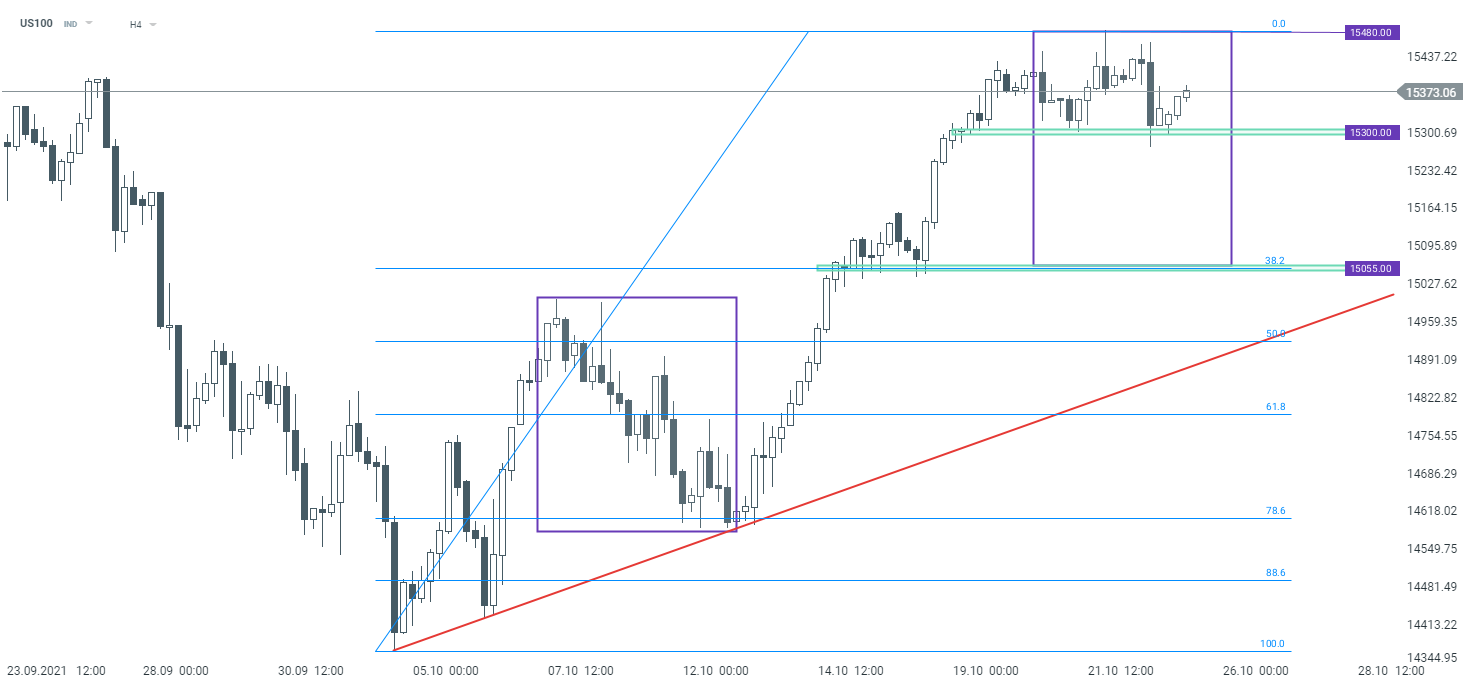

US equity indices continued to recover from September's correction last week. While S&P 500 and Dow Jones managed to reach fresh record highs, Nasdaq-100 (US100) lagged behind. US tech index halted advance in the 15,400 pts area and has traded sideways since. However, US100 is expected to become more active this week, thanks to earnings releases from top US tech companies scheduled for the coming days. Facebook will report earnings today after the close of the session, followed by Microsoft and Alphabet tomorrow in the evening. Reports from Apple and Amazon on Thursday will wrap up earnings season for US mega-caps. Chip shortages will be a key for Apple while ad demand will be in the spotlight during Facebook and Alphabet releases.

US mega-caps have a track record of beating earnings expectations. However, will it be enough to revive the recovery move on the US100? The index has been trading in the 15,300-15,480 pts range recently. Should earnings reports from US tech stocks disappoint, the index may find itself under pressure. A break below the lower limit of the range would pave the way for a drop towards the 15,055 pts area, where the lower limit of a market geometry can be found.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%