US100 (Nasdaq 100) rebounds by 0.50% to 19,400 points today after yesterday's declines following Nvidia's quarterly report release. The futures on the technology index closed yesterday with a drop of over 2.00%, despite the report exceeding analysts' expectations.

The initial reaction to the results was mixed, but afterward, the bears took control of the market, leading to declines. This shift in sentiment was observed across all major tech companies and in the AI sector. Although the results were solid, investor expectations were clearly higher. Today, we see a slight rebound in the US100 index, which may continue after the cash session opens. The aggregated analyst recommendations indicate an average index price of 22,145 points over the next 12 months. Considering a potential growth of 14.5%, this is quite substantial. Historically, analyst recommendations have suggested a growth potential of around 10%.

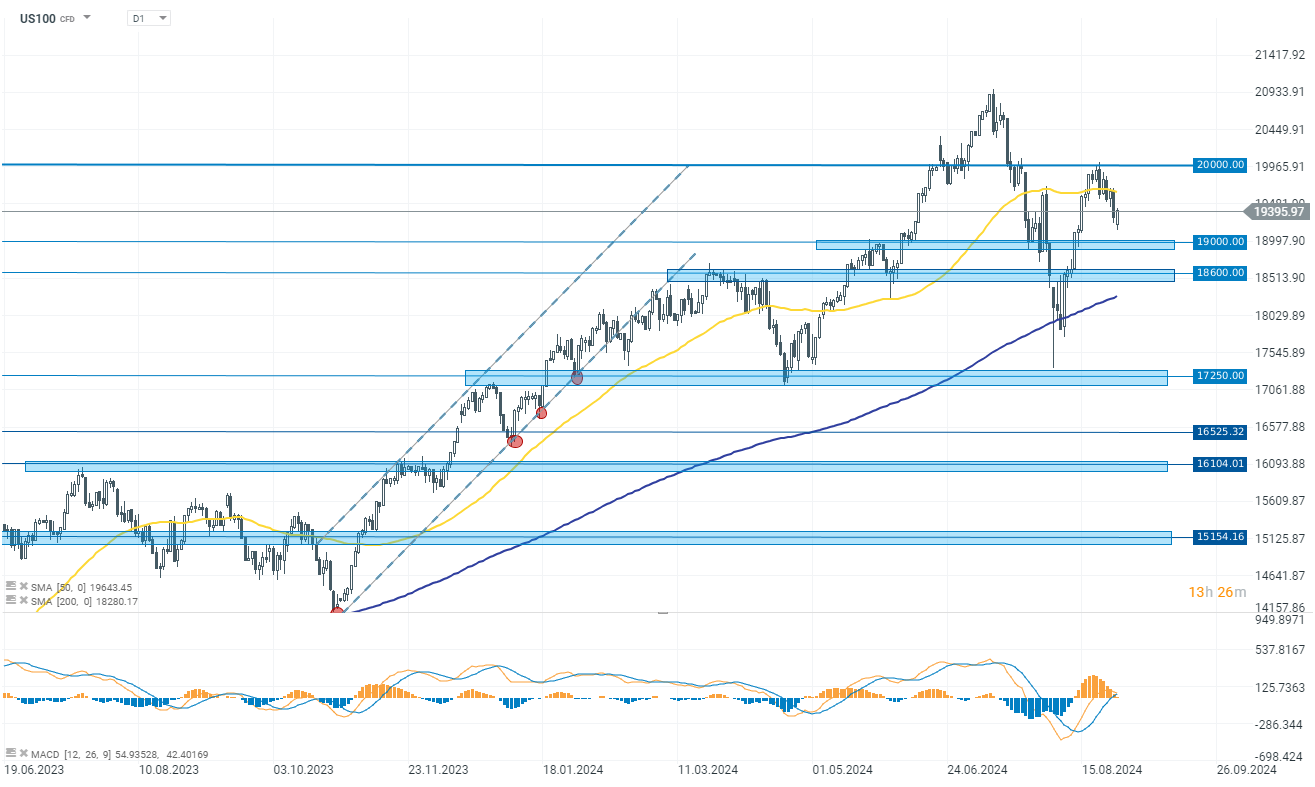

The tech stock index is gaining 0.50% today, reaching 19,400 points at the time of publication. From a technical analysis perspective, the most important level for the bulls to break remains the 20,000-point zone, where the recent upward movement was halted. On the other hand, if the declines continue, the key support zone to watch is around the 19,000-point level.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report