US indices performed well last week and managed to extend the recovery move. A new week began in rather downbeat moods but those started to improve after the launch of the European cash session and now US index futures are trading more or less flat on the day. The week ahead will be a big one for equities, especially US ones. Investors will be offered a policy decision from FOMC (Wednesday, 7:00 pm BST) as well as a US GDP report for Q2 2022 (Thursday, 1:30 pm BST). On top of that, 5 US mega tech companies will report earnings this week - Microsoft and Alphabet on Thursday, Meta Platforms on Wednesday while Apple and Amazon will report on Thursday. All of those events may have a significant impact on sentiment so traders should keep on guard in the next couple of days.

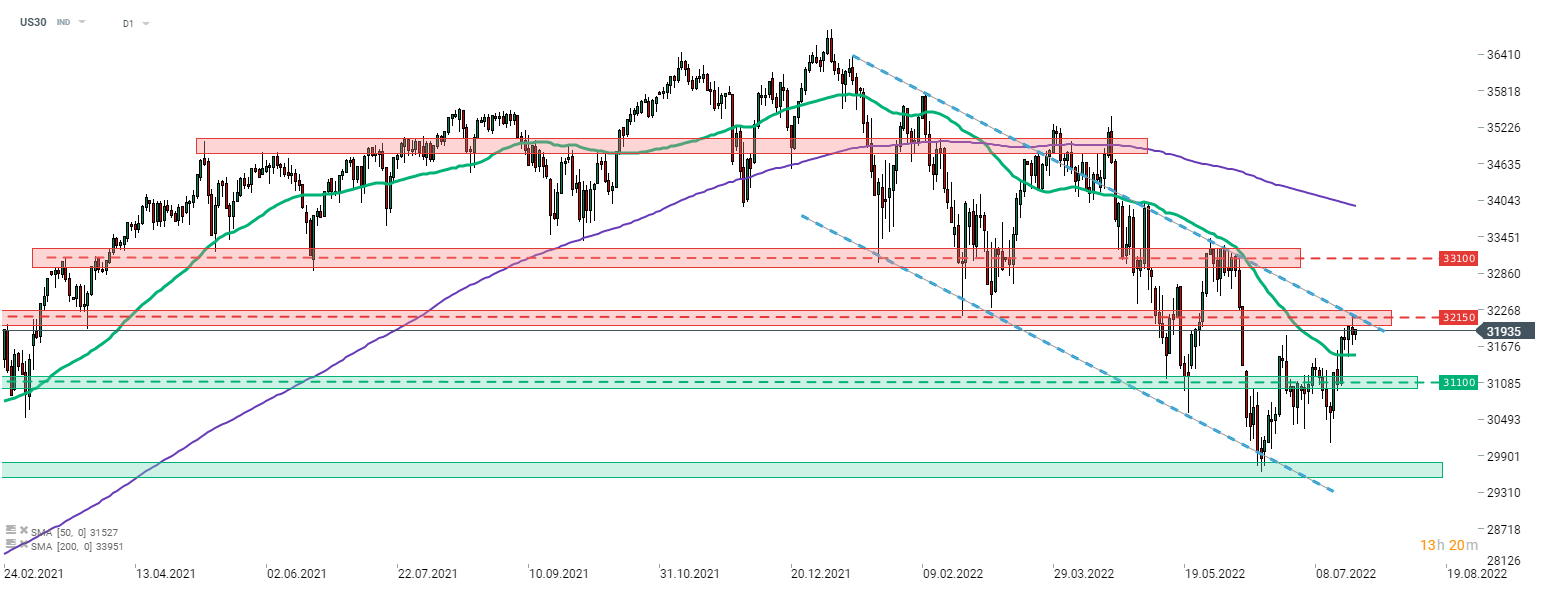

Taking a look at the Dow Jones chart (US30) at the D1 interval, we can see that the index has reached the upper limit of the downward channel last week. However, a spinning top candlestick was painted on Friday near 32,150 pts resistance zone signaling indecisiveness of investors'. Whether the index breaks above or pulls back from the aforementioned resistance may be decided by events later in the week (FOMC, GDP release). Should we see a break above, the next resistance to watch can be found at the previous local high (33,100 pts area). On the other hand, should sellers regain control and index starts to pull back, the downtrend will be maintained and a move towards the lower limit of the channel below 29,000 pts could be on the cards.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%