FOMC minutes released yesterday have been rather hawkish with the document noting that US central bankers do not expect rate cuts in 2023. It also noted that while progress has been made in bringing inflation back under control, more rate hikes are needed although a slower pace may be adequate. Release can be seen as hawkish but no major long-lasting market reaction occurred in the aftermath. This can be reasoned with the fact that FOMC minutes have only repeated what the market has already known and has already been pricing in.

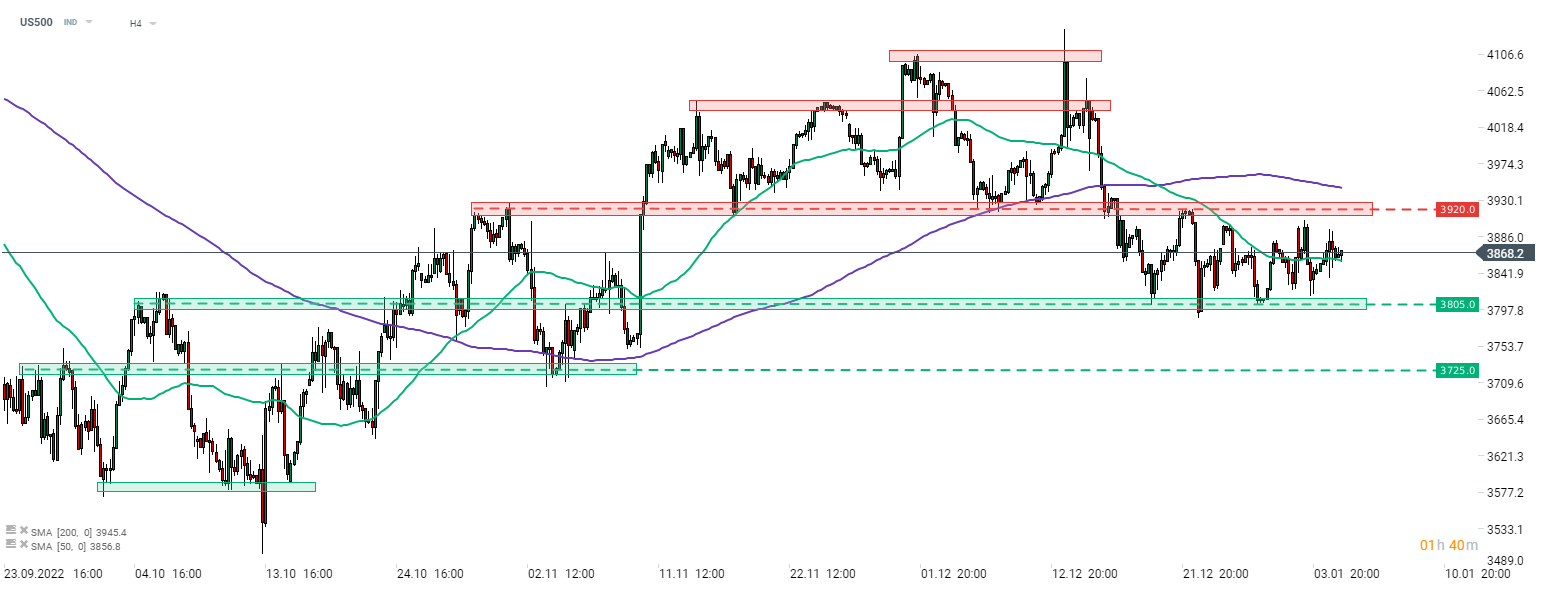

Taking a look at US500 chart at H4 interval, we can see that the index has been struggling to launch a larger move in either direction as of late. US500 has been trading in a 3,800-3,920 pts range since mid-December, awaiting catalyst for the next bigger move. While today's ADP employment report at 1:15 pm GMT is unlikely to be such a catalyst, tomorrow's NFP data may be source of elevated volatility.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?