- SP500 at new highs this year, CFD contracts above 4500 points.

- Gains on Wall Street driven by lower macro readings.

- Will earnings season revise market expectations?

On yesterday's session on Wall Street, there was a euphoric mood after the publication of CPI data, which, in short, turned out to be significantly lower than previous readings and analyst expectations. However, realistically looking at the readings, such a low figures was possible due to a high base from last year. Maintaining this pace of decline seems unlikely, although the direction, which is further declines, is not ruled out.

Wall Street is now entering the Q2 2023 earnings season, which will likely dictate the sentiment among investors for the next few weeks. The earnings season will kick off on Friday with the largest banks, including JPMorgan Chase & Co., Citigroup Inc., and Wells Fargo & Co. Overall, analysts' expectations are quite high, and the banking sector, influenced by high interest rates, is expected to report revenues higher by as much as 11% YoY. In this context, it can be both fuel for further growth and a catalyst for a correction in case of disappointment.

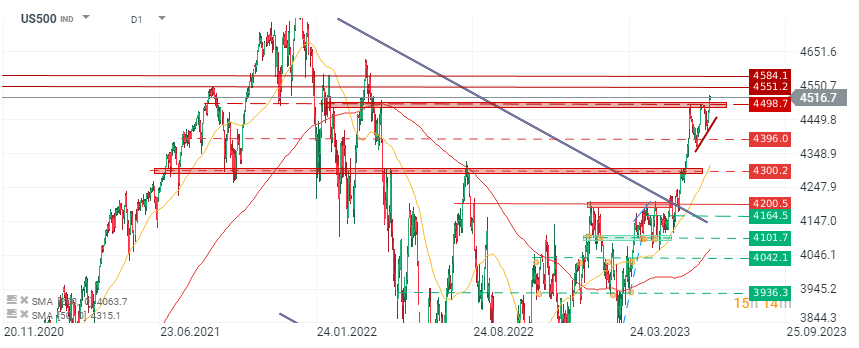

Fuelling by such a low CPI figures, investors pushed the SP500 index to new highs for this year, around 4472 points, while futures contracts on the XTB platform (US500) broke above 4500 points and the index is currently trading around 4520 points. Looking at the chart from a technical perspective, we can observe the next resistance zone around 4550-4580 points. The support zone is now at the 4500 level after yesterday's breakout, and further at 4400 points.

Fuelling by such a low CPI figures, investors pushed the SP500 index to new highs for this year, around 4472 points, while futures contracts on the XTB platform (US500) broke above 4500 points and the index is currently trading around 4520 points. Looking at the chart from a technical perspective, we can observe the next resistance zone around 4550-4580 points. The support zone is now at the 4500 level after yesterday's breakout, and further at 4400 points.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes