USDCAD is one of the currency pairs that may see elevated volatility this afternoon. This is because jobs data for June from the United States and Canada will be released at 1:30 pm BST. As usual, investors' attention will be focused primarily on US reading, especially after ADP data released yesterday showed an almost half a million employment gain.

Traders are eager to see whether NFP reading today will confirm this. While ADP has been a rather poor predictor of NFP readings over the past years, the two has been coming in more or less in-line with one another over the past 3 months. A strong NFP reading would likely make July rate hike a done deal (money markets currently see an around 85% chance of 25 bp rate hike) and would likely boost hawkish bets for the later meetings.

When it comes to data from Canada, the market expects an employment gain in June, following a drop in May, as well as an uptick in the unemployment rate. Markets are less convinced what Bank of Canada will do at July meeting than in the case of Fed but are also inching closer to a 25 basis point rate hike with almost 60% chance of such a move already priced in. Note that BoC will meet as soon as next week (July 12, 2023)

US, NFP report for June

- Non-farm payrolls. Expected: +225k. Previous: +339k (ADP: +497k)

- Unemployment rate. Expected: 3.6%. Previous: 3.7%

- Wage growth. Expected: 4.2% YoY. Previous: 4.3% YoY

Canada, jobs data for June

- Employment change. Expected: +21k. Previous: -17.3k

- Unemployment rate. Expected: 5.3%. Previous: 5.2%

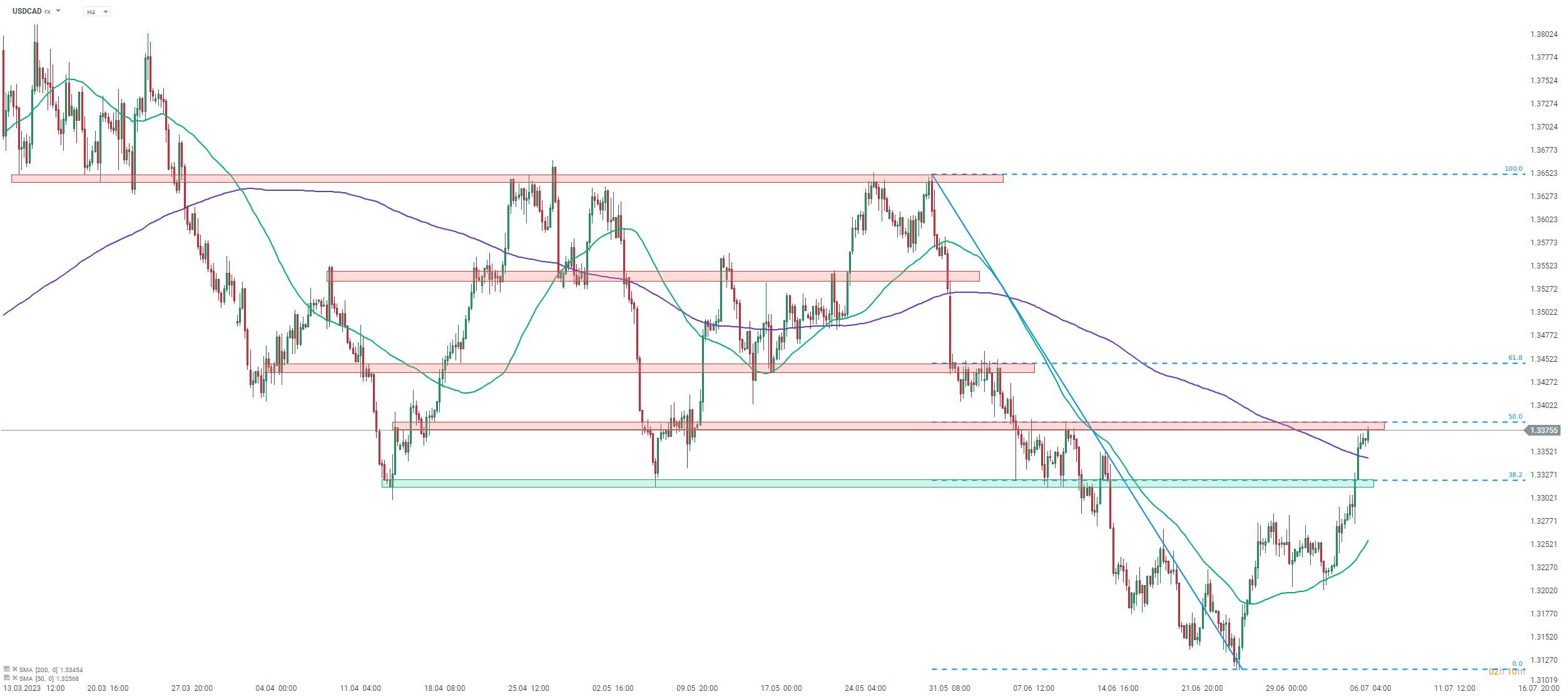

Taking a look at USDCAD chart at H4 interval, we can see that the pair has been trading higher as of late, thanks to strengthening of US dollar. Pair managed to climb above the price zone, marked with 38.2% retracement of the downward move launched in late-May, and continued to move higher, through the 200-period moving average (purple line). Resistance zone marked with 50% retracement is being tested at press time and we will likely have to wait until jobs data release at 1:30 pm BST to see whether the pair breaks above the area or pulls back from it.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️