The Bank of Canada is set to announce monetary policy decisions today at 3:00 pm BST. However, the Canadian central bank is expected to stay on hold this time as risks to the outlook mount and uncertainty mount. Data from the country has been weaker recently and rising Delta case count and related restrictions are adding to uncertainty. Moreover, BoC is expected to review its forecasts and publish a new set of projections during its next meeting (October 27, 2021). Having said that, it looks prudent for the central bank to wait with any major announcements until then.

There is also another factor that may encourage BoC not to make a move today. Federal elections in Canada are scheduled for Monday September 21. Elections always come with a degree of uncertainty about the outcome and BoC may not want to add more uncertainty at this point.

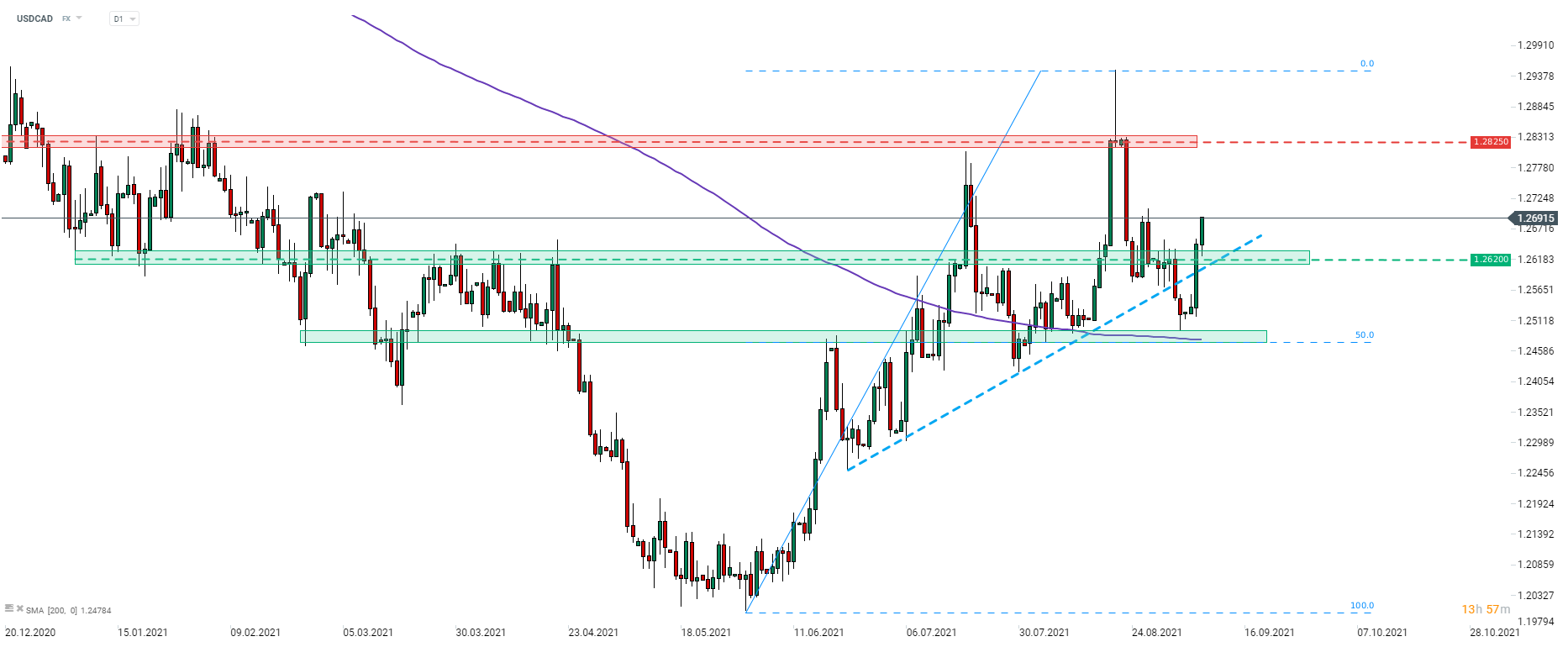

Taking a look at USDCAD from a technical point of view, we can see that a recent sell-off on the pair was halted at the support zone marked with 200-session moving average and 50% retracement of the upward move launched at the beginning of June 2021 (1.2500 area). Pair has subsequently climbed back above the upward trendline and the 1.2620 swing area. The next resistance level to watch should the recovery continue can be found in the 1.2825 area. Note that reaching this zone, failing to break above and pulling back may paint the right arm of a potential head and shoulders pattern with the aforementioned 1.2500 serving as a neckline.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%