US CPI report for May is a key macro release of the day. While median consensus among economists is for the headline price growth to stay unchanged at 8.3% YoY, there were reports saying that White House is actually expectating a higher reading as high oil prices start to be reflected more at the pump. Core gauge is expected to decelerate below 6% YoY. Nevertheless, those are still high readings and even a slowdown in core price growth will not discourage Fed from delivering another rate hike next week, most like a 50 basis point hike.

Apart from the US CPI report for May, traders will also be offered a jobs report from Canada, which will be released at 1:30 pm BST as well. Market expects an employment gain of 29.5k in May, almost double that from April, and the unemployment rate to stay unchanged at 5.2%.

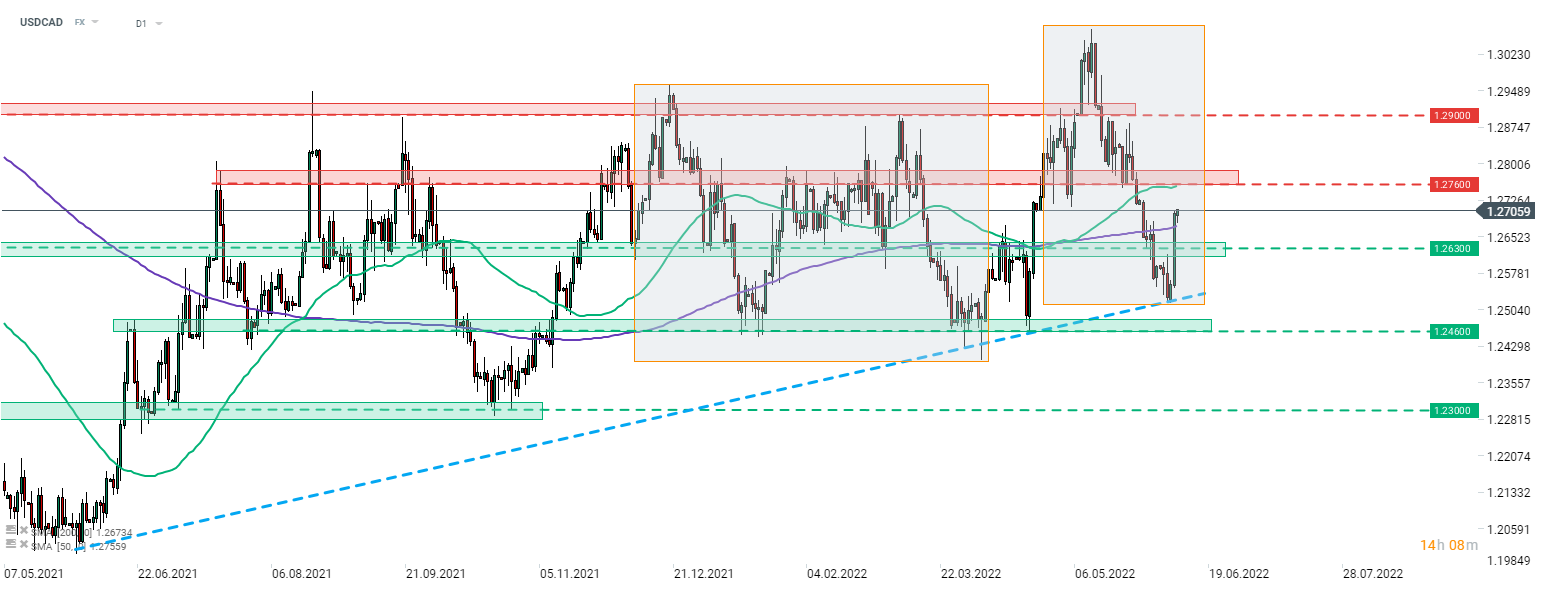

Combination of those two releases is likely to trigger a spike in volatility on the USDCAD market at 1:30 pm BST. Taking a look at the pair at D1 interval, we can see that it has managed to halt correction and bounced off the 1.2510 area, marked with the upward trendline and lower limit of the Overbalance structure. The pair rallied yesterday and broke above the 200-session moving average paving the way for a test of the 1.2760 resistance.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️