USDCAD is trading higher today, thanks to the strength of the US dollar. However, it does not mean that the Canadian dollar can be named a laggard. In fact, Canadian currency is the second best performing in the G10 basket today, being supported by an increase in oil prices and a general improvement in risk moods. The day ahead is light in terms of macroeconomic releases but CAD will get a chance to move in the afternoon during speech from BoC Governor Macklem at 3:00 pm GMT.

Tiff Macklem, Governor of the Bank of Canada, will deliver a speech today at 3:00 pm GMT. It is rumoured that Macklem will present results of policy framework review. It is expected that the current framework, assuming a 2% inflation goal, will be renewed for another 5 years. This looks like a probable topic of today's speech, as a joint press conference of BoC Governor and Canadian finance minister is scheduled for 4:00 pm GMT (BoC policy framework is jointly agreed between BoC and Finance Ministry).

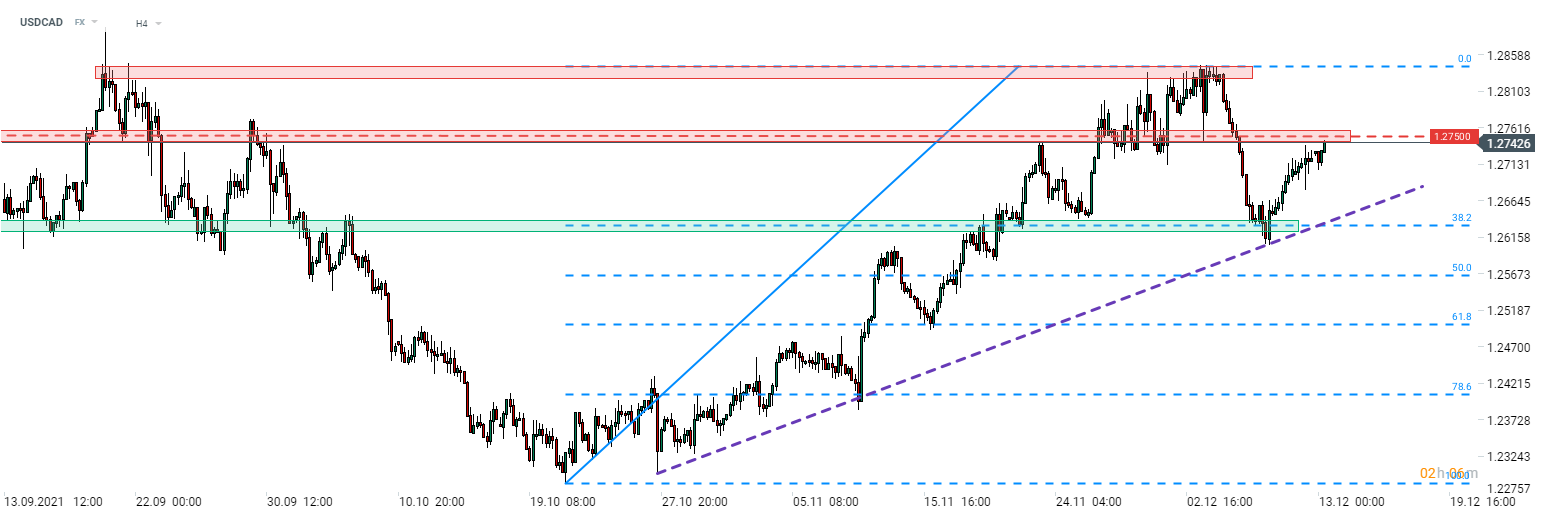

A look at USDCAD chart shows us that the pair halted short-term downward correction at the 38.2% retracement of recent downward impulse and started to regain ground later on. USDCAD climbed back and is now testing a key 1.2750 resistance zone, which is marked with the 61.8% retracement of the correction move from the beginning of last week. A break above this zone would pave the way for a test of recent highs at around 1.2840.

Source: xStation5

Source: xStation5

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

Three Markets to Watch Next Week (02.01.2026)

BREAKING: US December manufacturing PMI holds at 51.8; eases from 52.2 in November📌

Technical Analysis - USDIDX (02.01.2026)