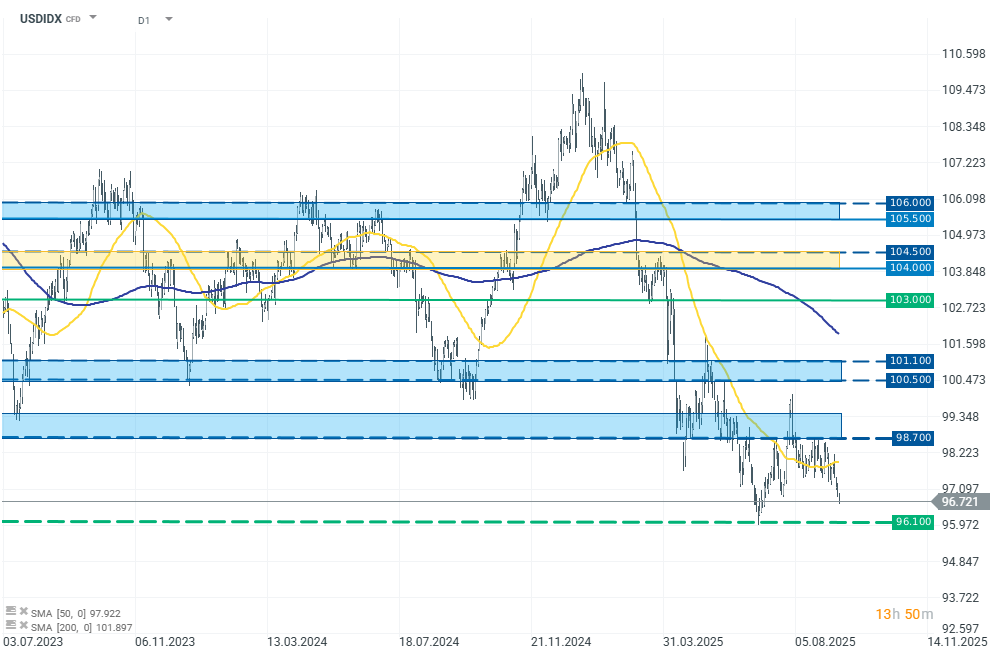

The U.S. dollar is losing ground for another consecutive day. At the start of the European session, the dollar index is down −0.30%. The market expects a 25bp Fed rate cut and a dovish press conference from Jerome Powell.

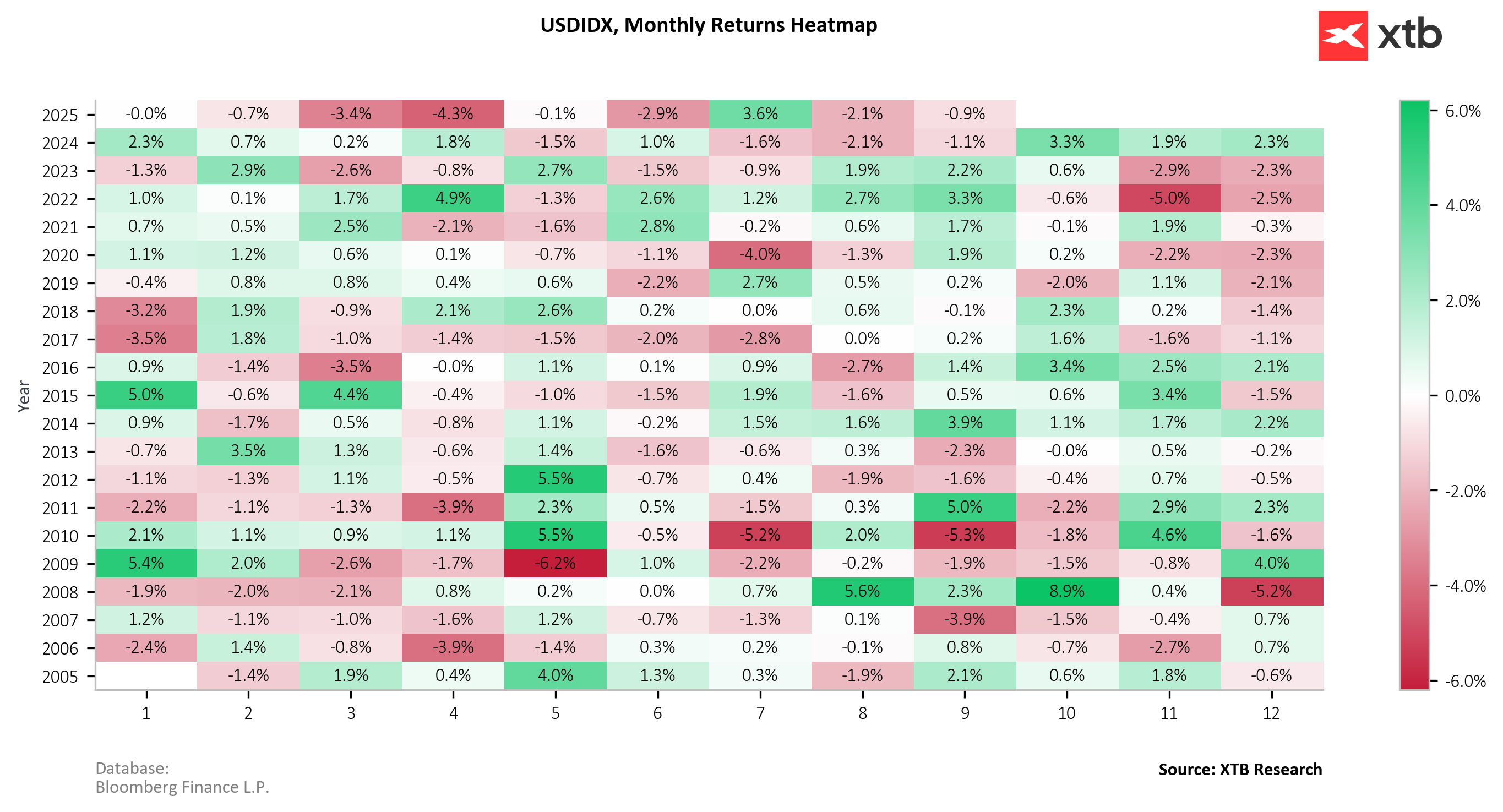

Donald Trump’s policy is clearly weighing on the U.S. currency. Trump has publicly expressed a desire to devalue the dollar. Considering that since the beginning of the year there has been only one positive month, it can be said that the president is carrying out his strategy. The dollar’s weakness is driven by several factors, including the trade war, political uncertainty, and the upcoming rate cuts.

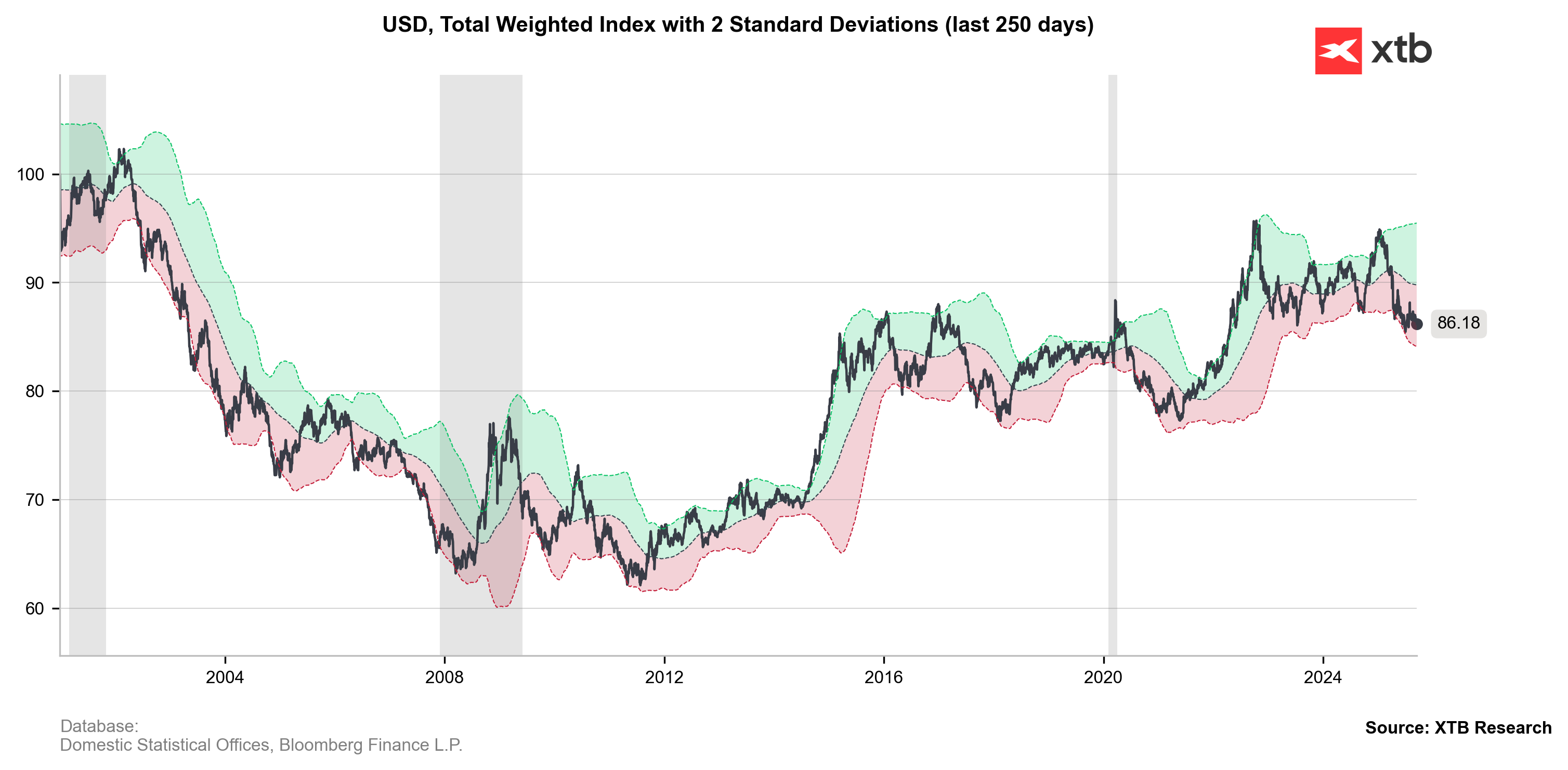

For several months now, the dollar has been trading at the lower end of its channel, near two standard deviations. However, in the case of a prolonged downtrend, such levels can be sustained for an extended period.

Since mid-June, the dollar has remained within the current consolidation channel. The upper boundary has been tested multiple times without a lasting breakout. The dollar is now approaching the lower boundary, and a retest of support above 96.1000 points cannot be ruled out.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉