There is still no end to the war between Israel and Hamas in the Gaza Strip. Large-scale fighting began exactly 4 months ago when Hamas fighters breached into Israel on October 7, 2023. However, negotiations on hostage release and ceasefire have been making progress recently. An agreement proposal drafted in Paris by negotiators from Egypt, Qatar, United States and Israel has been met with a 'positive response' from Hamas, according to Qatari officials. Moreover, it was reported today that Hamas proposed indirect talks with Israel to end military operations and restore total calm. A report from al-Arabiya further stated that the group's proposal calls for a 135-day truce in three stages.

Those are all positive, but there is still a long road until ceasefire or the end of hostilities can be achieved. Given that Hamas calls for destruction of the Israeli state and Israel calls for destruction of Hamas, any truce would likely be fragile. Still, a pause in fighting, even if temporary, may help restore calm in the region and prevent war from spreading into neighboring Lebanon. It may also help ease tensions between Israel allies, namely US and UK, and other Iranian proxy groups, like Yemeni Houthis.

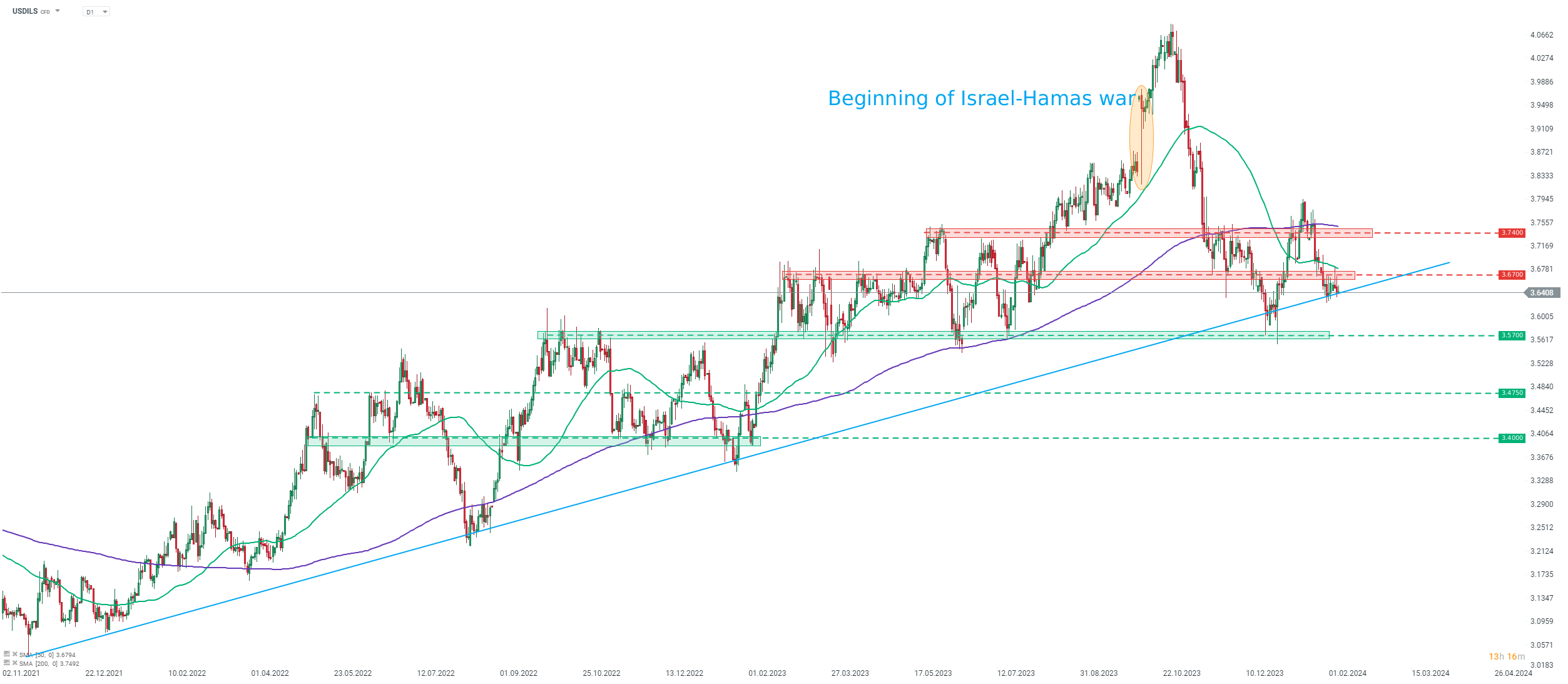

Recent news headlines on Israel-Hamas negotiations had a rather small impact on Israeli shekel. However, as there is more and more positive news surfacing on the matter, a breakthrough in talks cannot be ruled out and it could be a mover for ISL. This makes USDILS an interesting pair to watch given that it trades in an interesting technical spot. Taking a look at USDILS chart at D1 interval, we can see that the pair is trading near the medium-term upward trendline. Previous break below this trendline, made at the end of December 2023, turned out to be short-lived and was halted at the 3.57 support zone.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)