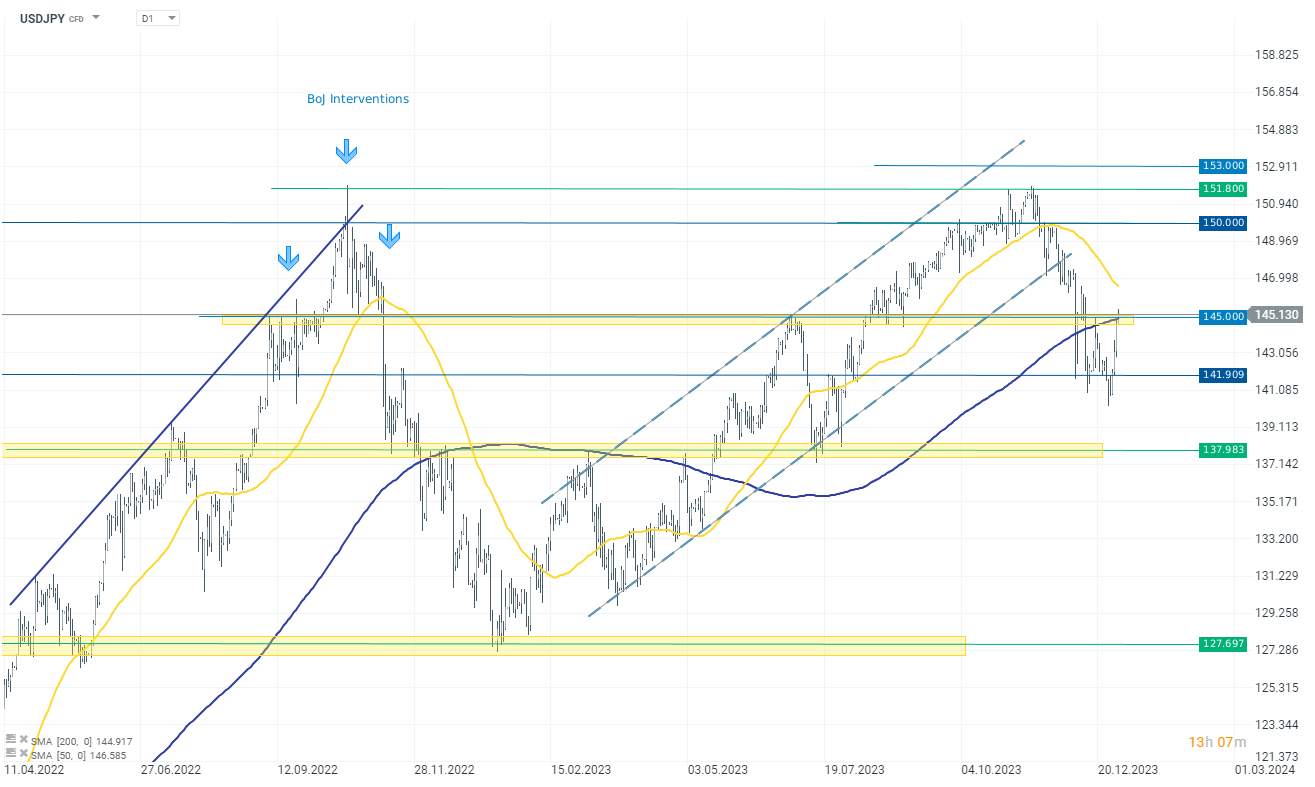

USDJPY is in a key resistance zone at the level of 145. Today we had several interesting publications from Japan, but the significance of these data was rather secondary:

- Household confidence index: 37.2 (expectations 36.6; previously 36.1)

- Monetary base y/y: 7.9% (expectations 9.0%; previously 8.9%)

- PMI for services (au Jibun Bank): 51.5 (expectations 52.0; previously 50.8)

Data from Japan suggest a good condition of the economy. PMI is performing much better than data from Europe, and even from the USA. The household confidence index indicates good sentiment in this sector. Worse for the Yen are the data on the monetary base, which, after reaching a local peak in November 2023, is currently gradually decreasing. This theoretically leads to less pressure on price increases.

Looking at the recent behavior of USDJPY, we see a decisive reaction after reaching a local bottom around 140 JPY per USD. The basis for the current upward movement is mainly the increase in the value of the dollar, but we can also observe short-term weakness on the yen. Currently, USDJPY is at a key resistance zone at the level of 145, which in July 2023 effectively halted the increases and marked a local peak in the rate. If this zone is broken, we may see an upward movement even around 147-149,000.

Source: xStation 5

Three Markets to Watch Next Week (16.01.2026)

Chart of the day: USD/JPY under pressure from BoJ and Japanese policy (January 16, 2026)

Morning wrap (16.01.2026)

📉EURUSD loses 0.3%