The Japanese yen has been experiencing significant volatility recently, rising concerns among government leaders in Japan. The country's Vice Minister of Finance for International Affairs, Masato Kanda, alongside other officials, have communicated the possibility of stepping in to maintain yen stability and curb speculative trading, citing activities that are not in line with the fundamental economic indicators as a cause for the current volatility.

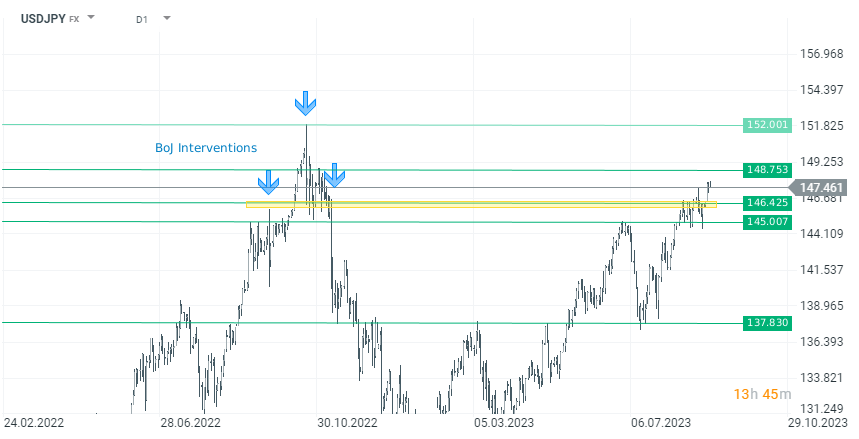

The government last initiated such measures in October the previous year, indicating serious concerns and a readiness to take firm actions. However, since the USDJPY decline past the 145 in August, the government eased on its warnings, leaving traders in a state of uncertainty regarding potential intervention strategies. Recent developments have once again seen the yen declining to its lowest point in ten months, nearing the critical levels that have historically prompted government intervention. Market experts noted that a further dip of USDJPY reaching a 150 level could potentially be the tipping point again forcing the government to market intervention.

Source: xStation 5

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️