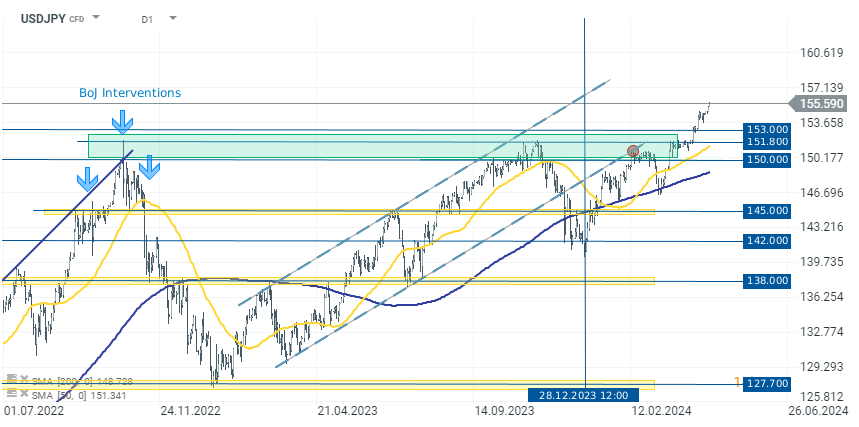

The Japanese yen is again one of the weakest currencies among the G10 today, falling to record low levels the day before the Bank of Japan (BOJ) decision. At the time of publication, the JPY losses 0.3-0.4% despite a calm start of the day on the forex market. USDJPY is up 0.30% to 155.700. The weakness of the JPY stems from a lack of investor confidence that the BoJ can effectively defend further currency depreciation.

At tomorrow's meeting, the BOJ is expected to keep the benchmark interest rate at 0.1%. This decision follows the BOJ's discontinuation of yield curve control and asset purchases, signaling a shift in policy, albeit with a continuing dovish outlook on future rate adjustments.

- Analysts remain skeptical of any significant policy change that could strengthen the yen, suggesting that the central bank will likely maintain its dovish stance.

- Bank of America has issued a warning that the USDJPY rate could quickly rise to 160, as the Bank of Japan appears largely powerless to stop this rise using only its verbal interventions.

- On the other hand, Stever Barrow, head of G-10 strategy at Standard Bank, claims that the Bank of Japan could intervene to sell USDJPY as early as Friday. He believes that the Bank of Japan might discuss intervention at its meeting on Friday, Japan time. The intervention could occur during American hours or shortly thereafter.

There are no shortages of voices speaking for further weakening of the yen and the necessity for BOJ intervention. The coming weeks could be crucial for the long-term trend. Today, USDJPY weakens to new record levels at 155.700.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️