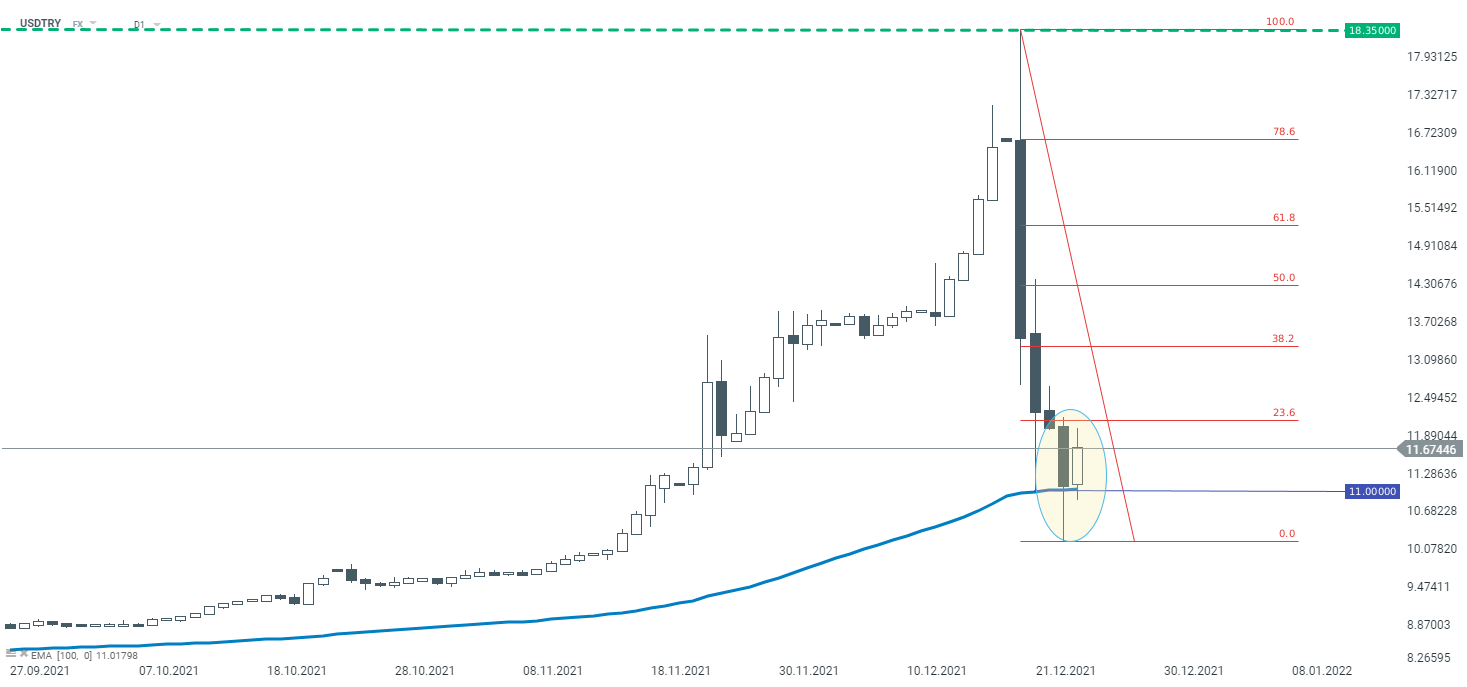

Erdogan and his administration decided on a set of measures aimed at stabilizing the situation on TRY this week. This resulted in a strong strengthening of the Turkish currency. The recent sell-off on the USDTRY currency pair reached more than 40%, however, it should be noted that the pair is trading at over 50% higher year to date. Despite the measures taken, the fundamental factors are negative for the lira and speculators may soon return to shorting Turkish lira and testing limits of central bank and government ability to defend the TRY rate.

Looking at the D1 chart, if the today's bullish sentiment continues until the end of the day, there is a chance for painting a bullish engulfing pattern, which usually heralds an upward move. In addition, one should see, the rebound occurred at the height of the important support - the 100 -period moving average (11.00), which may encourage the market bulls to be more active. In case of an upward movement happen, the internal Fibonacci retracements should be considered as nearest resistances.

USDTRY D1 interval. Source: xStation5

USDTRY D1 interval. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts