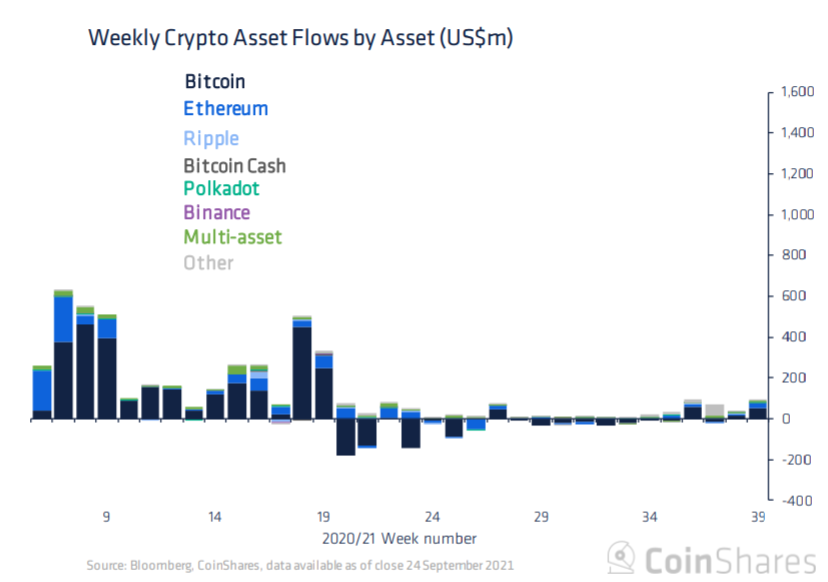

Despite recent volatility in the market caused by China’s crackdown on cryptocurrencies, it seems that institutional investors treated last week's crypto market crash as a buying opportunity. Recent data from CoinShares revealed $95 million worth of inflows into digital asset products last week, marking a 126% weekly increase.

Digital asset investment products saw inflows totaling US$95m last week, bringing the total run of inflows over the last 6 weeks to US$320m. Source: CoinShares

Digital asset investment products saw inflows totaling US$95m last week, bringing the total run of inflows over the last 6 weeks to US$320m. Source: CoinShares

Bitcoin saw the largest inflows of USD $50m. Bitcoin investment products have recorded an increase of 234% week-over-week. Meanwhile Ethereum recorded inflows totaling USD$29m last week which may indicate that institutional investors maintain a bullish stance towards the cryptocurrencies.

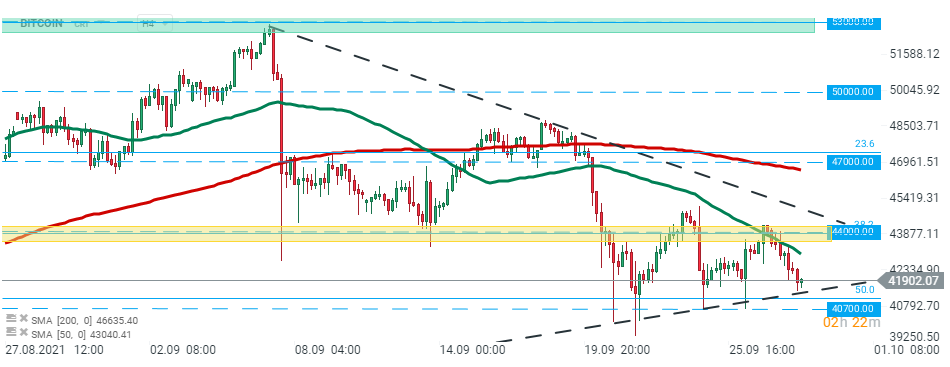

Bitcoin - bulls failed to stay above major resistance at $44,000, which is marked with the 38.2% Fibonacci retracement of the last upward wave, and price pulled back. Currently Bitcoin is testing an upward trendline which coincides with 50% retracement. Should break lower occur, then downward move may accelerate towards support at $40,700. On the other hand, if buyers manage to halt declines here, then another upward impulse towards aforementioned resistance at $44,000 may be launched. Source: xStation5

Bitcoin - bulls failed to stay above major resistance at $44,000, which is marked with the 38.2% Fibonacci retracement of the last upward wave, and price pulled back. Currently Bitcoin is testing an upward trendline which coincides with 50% retracement. Should break lower occur, then downward move may accelerate towards support at $40,700. On the other hand, if buyers manage to halt declines here, then another upward impulse towards aforementioned resistance at $44,000 may be launched. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?