Chinese indices have been underperforming massively over the past 3 sessions. CHNComp dropped almost 12% compared to Thursday's close. Crackdown on Chinese educational stocks is named as a reason behind the drop. However, sell-off extended beyond educational stocks and is heavily impacting the overall tech sector. Increased uncertainty, related to big jumps in new Covid-19 cases and risk of Olympics becoming a super-spread event, is also contributing to risk-off moves on the European stock markets as well as US futures.

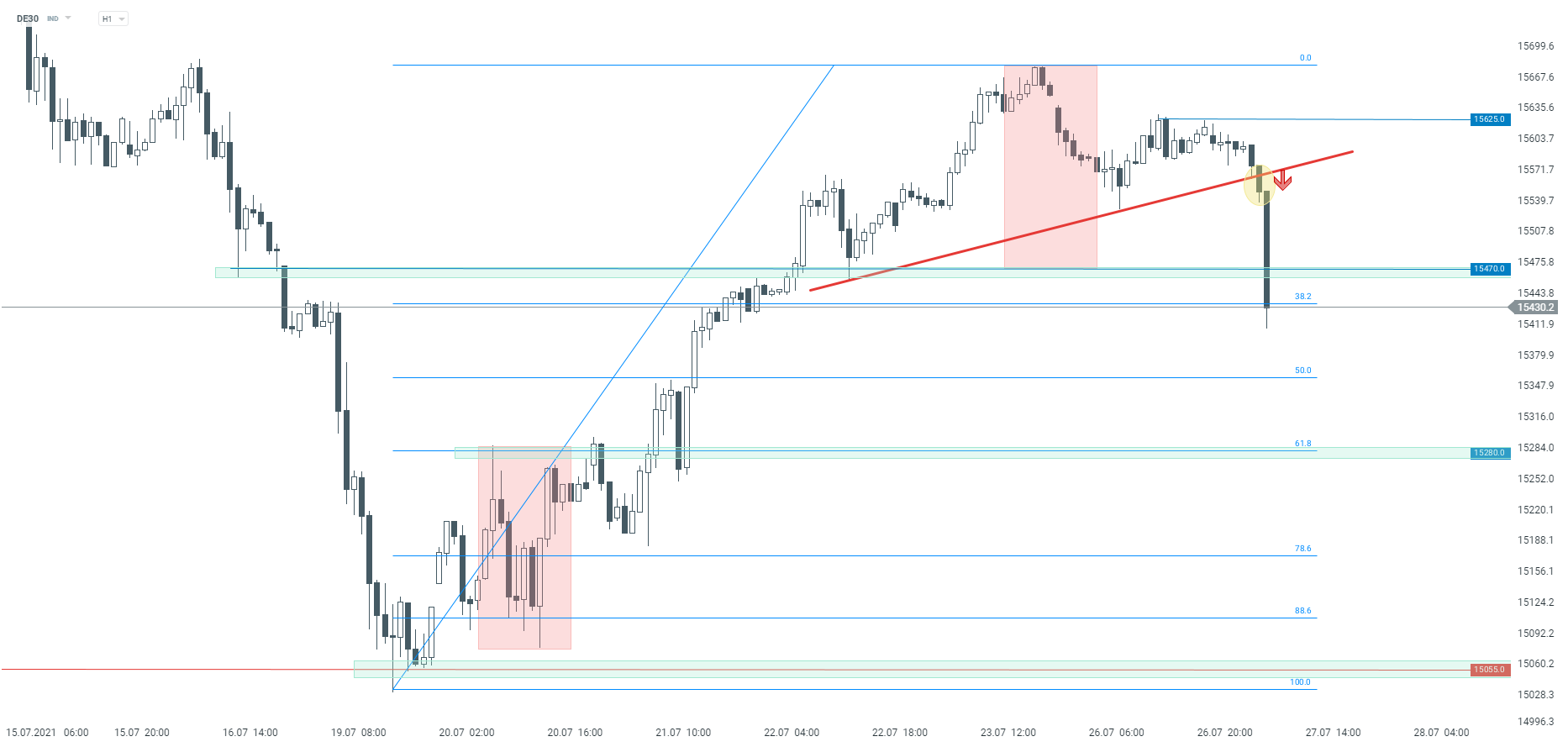

German DAX (DE30), UK FTSE 100 (UK100), Dutch AEX (NED25) and Italian FTSE MIB (ITA40) are all trading over 1% lower at press time. Taking a look at the DE30 chart, we can see that the index broke below the short-term upward trendline and downward move accelerated. The index broke below the lower limit of the Overbalance structure later on and is currently testing 38.2% retracement of the upward impulse launched in mid-July (15,430 pts area). The next near-term support for the index can be found on 50% and 61.8% retracements.

Source: xStation5

Source: xStation5

Market overview: PMI shapes European markets🚨

Morning wrap (23.01.2026)

US Open: Rebound attempt on Wall Street 📈Meta Platforms surges 3.5%

VIX sell-off deepens amid rebound on Wall Street 📉