A wave of optimism on Wall Street is pushing CBOE VIX futures lower. Over the past 30 years, there have been only a handful of instances when the VIX surged by roughly 25% in a single session and then closed the following day about 15% lower. Historically, this pattern has tended to precede weaker performance in both the S&P 500 and the Nasdaq 100 over the days that followed, particularly over a one-week horizon.

- Even so, equities are extending gains today as well. Hopes for easing tensions around Greenland, along with the decision to suspend an additional 10% tariff rate on eight EU countries, have calmed markets that had previously been pricing in the risk of an escalating trade war.

- From a dealer gamma perspective, yesterday’s key positive-gamma area for S&P 500 options was around 6,875, while the gamma flip level—where dealers are forced to “follow” the market and buy into strength - sat near 6,847.

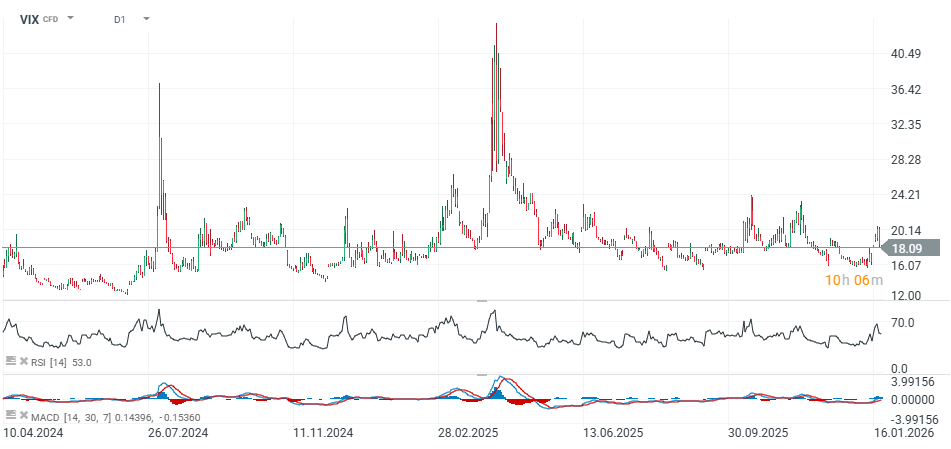

- If the uptrend in equity indices holds, the VIX could retreat again toward the 16 area. Conversely, if sentiment reverses sharply and the US equity sell-off deepens, a retest of the 21 zone cannot be ruled out (the upper side of the price channel).

VIX index (H1 timeframe)

Source: xStation5

VIX index (H1 timeframe)

Looking at the VIX on a higher timeframe, we can see that sharp pullbacks have often preceded sudden volatility spikes.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street