Indices in the Asia-Pacific region mainly record a negative session, except for China. Chinese indices are dynamically gaining between 4.00-5.00% following a reportedly submitted request from the China Securities Regulatory Commission for support in the stock market. According to confidential information, Chinese President Xi Jinping received information from Chinese regulatory bodies about the necessity to support financial markets and prevent further price declines. Stocks in China and Hong Kong have lost about 7 trillion dollars in value since their peaks in 2021.

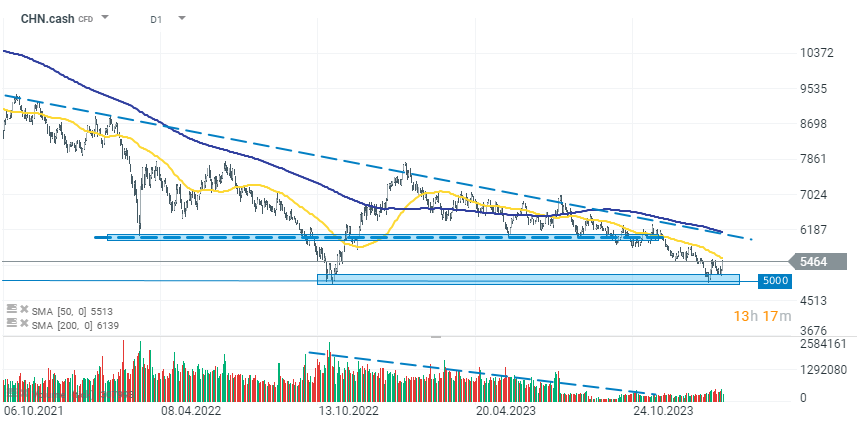

CHN.cash (D1)

Today's increases in China are also a reaction to the recent dynamic declines. Chinese indices remained in an overbought area over the past months, while markets in Europe and the USA reached new historical highs. On the daily interval, we observe a bullish reaction after the index formed a double bottom around the 5000 points level. Currently, the benchmark is testing an important resistance area defined by the 50-day exponential moving average (yellow line on the chart).

Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report