Citigroup (C.US) reported Q4 2022 and full-2022 earnings today ahead of the Wall Street session open. Results turned out to be mixed. Revenue came out to be slightly better-than-expected while earnings missed. Bank reports a solid beat in fixed income trading revenue. Full-year fixed income revenue increased 13% YoY. Situation did not look so rosy in the case of equity trading as Q4 2022 revenue dropped 14% YoY and full-year revenue dropped 9% YoY. Nevertheless, Citigroup said that it is on track to meet its medium-term return targets. However, investors do not seem to be convinced as Citigroup's shares trade almost 3% lower in premarket.

Q4 2022 results

-

Revenue: $18.0 billion vs $17.96 billion expected (+6% YoY)

-

Net income: $2.5 billion (-21% YoY)

-

EPS: $1.16 vs $1.21 expected

-

Fixed income trading revenue: $3.16 billion vs $2.81 billion expected (+31% YoY)

-

Equity trading revenue: $0.79 billion (-14%)

-

Return on equity: 5.0%

Full 2022 results

-

Revenue: $75.3 billion (+5% YoY)

-

Net Income: $14.8 billion (-32% YoY)

-

EPS: $7.00

-

Fixed income trading revenue: $14.55 billion (+13% YoY)

-

Equity trading revenue: $4.56 billion (-9% YoY)

-

Return on Equity: 7.7%

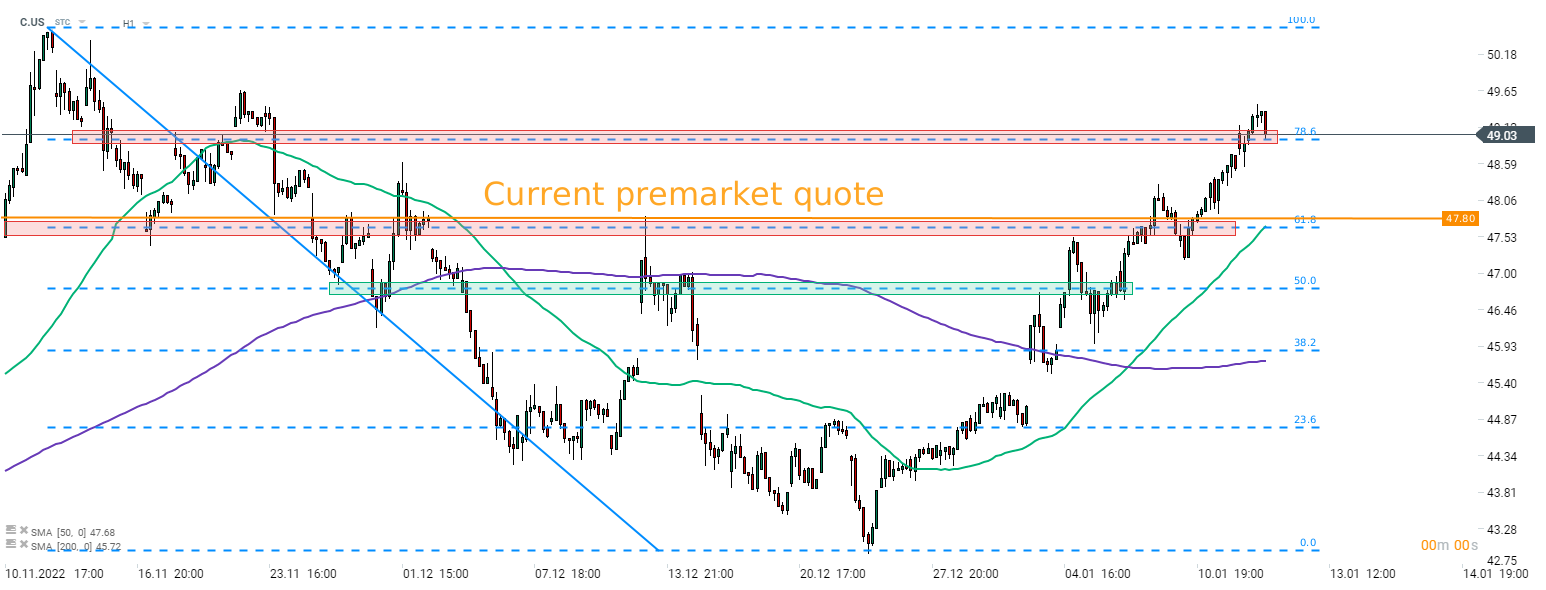

Citigroup stock (C.US) is currently trading around 3% lower in pre-market, around $47.80. A short-term price zone ranging around 61.8% retracement of the downward impulse started in early-November 2022 can be found slightly below this price level. A break back below this area would pave the way for a drop towards the next support in line - 50% retracement in the $46.80 area.

Citigroup (C.US) at H1 interval. Source: xStation5

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Largest in its class: What do BlackRock’s earnings say about the market?

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎