Cocoa rallies 7% today and has fully recovered from the correction that occurred at the beginning of this week. Moreover, price moved above $10,800 per ton reaching a fresh all-time high. The move higher today is fuelled by release of solid Q1 cocoa grinding data from Asia and Europe.

While cocoa grinding in Q1 2024 was lower than in Q1 2023, it was higher than in Q4 2023. Markets are taking it as a sign that massive price rally did not lead to a demand destruction. However, cocoa that was processed in the January-March 2024 period was most likely purchased in the previous year, when prices were not as high as they are now. Having said that, grinding data for Q2 and Q3 2024 will be more reflective of the actual demand situation on cocoa market. Nevertheless, investors seem happy that no major slump occurred in grinding as early as Q1 2024 and today's price jump reflects it.

Q1 grinding data from North America will be released today in the evening (9:00 pm BST), but their impact on prices will not be known until cocoa market opens tomorrow at 9:45 am BST.

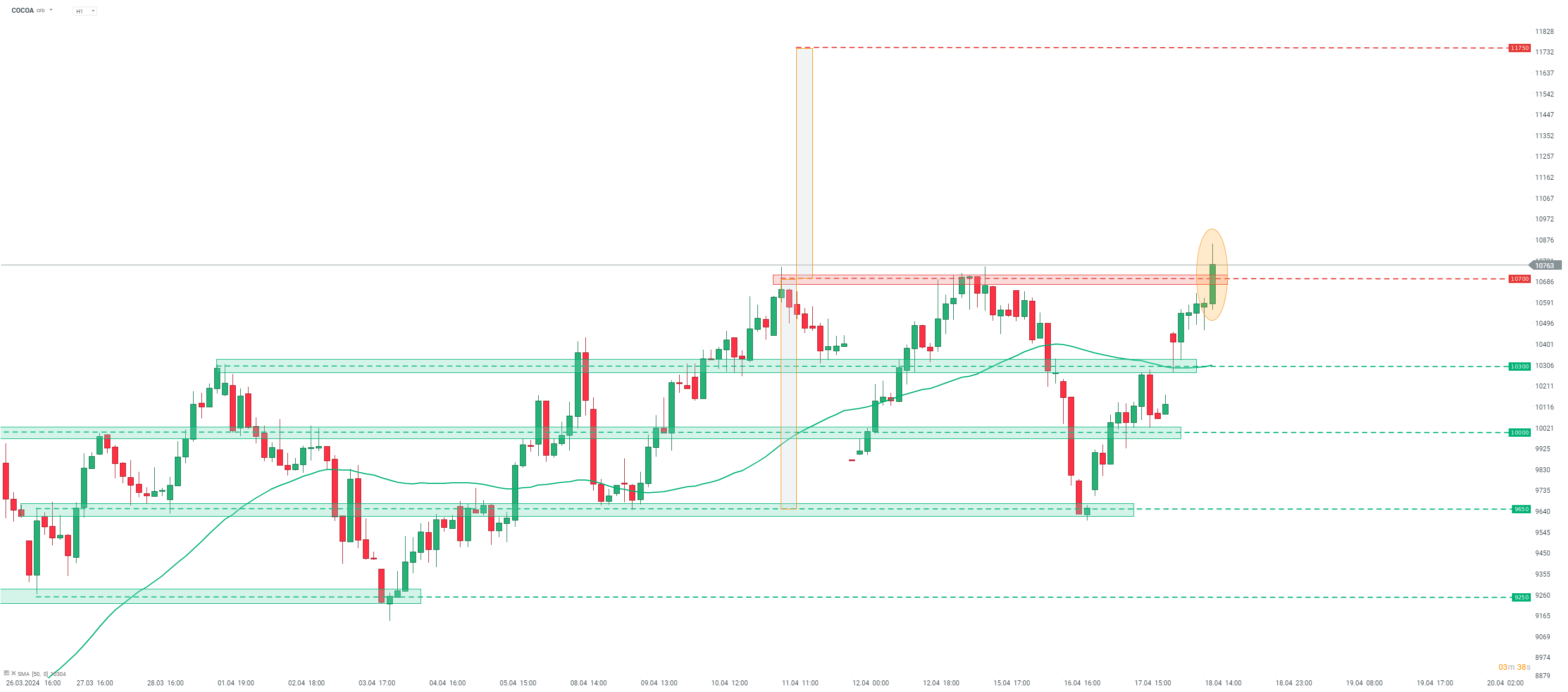

Taking a look at COCOA chart at H1 interval, we can see that the price has been trading sideways in the $9,650-10,700 range recently and is breaking above the upper limit of this range today.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74