Cocoa futures on ICE (COCOA) are down almost 3.5% today amid markets focusing on 2025/2026 season, expecting strong supply improvement. The start of the crop season in the Ivory Coast scheduled at October 1 (world’s largest cocoa producer), brought the prospect of fresh supply to the market. In the effect, cocoa prices are down more than 50% from the ATH.

Now markets await grinding data from key cocoa markets, scheduled next week. In the data will be lower than expected, which is a probable scenario, we may expect the head and shoulders technical pattern confirmation, and increase sell-side pressure on cocoa futures amid speculators and market participant focus shifting from tight supply to low demand environment, and a significant improvement of cocoa production, next year.

Source: xStation5

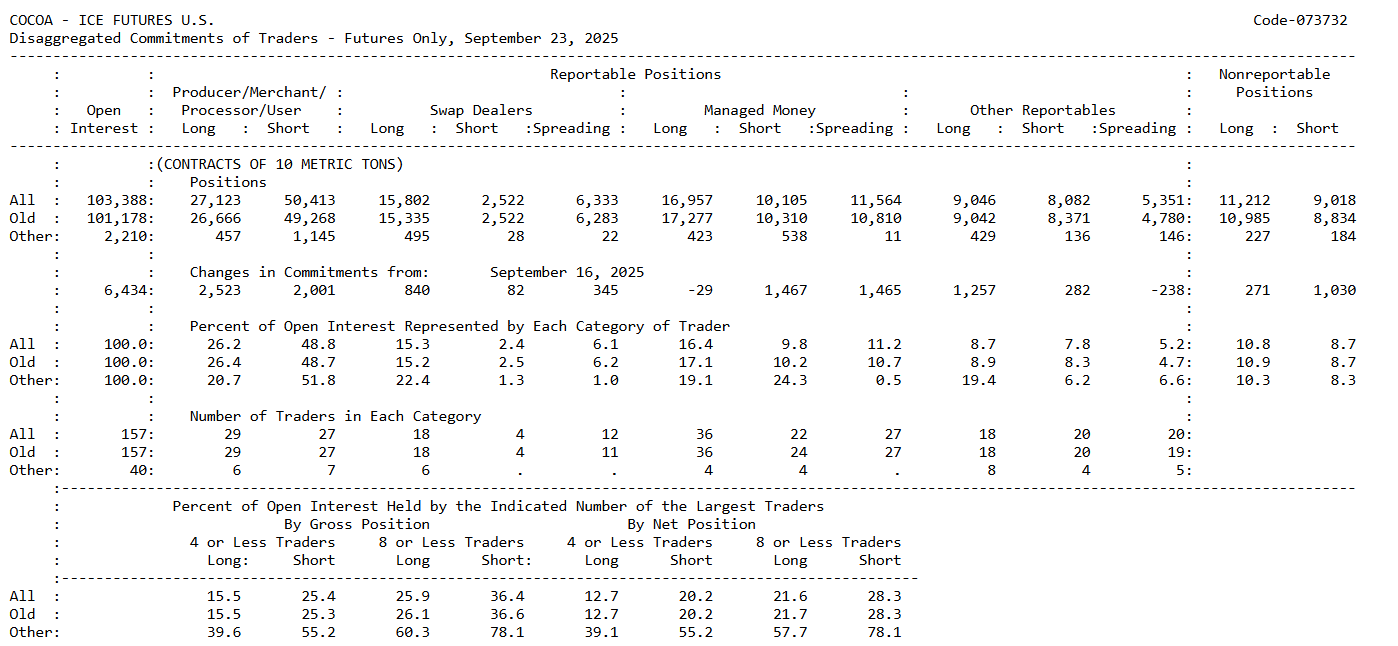

Cocoa Market Outlook (CoT – September 23, 2025)

Commercials (Producers/Merchants/Processors/Users)

-

Positioned strongly on the short side: about 50.4k short contracts vs. 27.1k long.

-

This is a classic hedging stance – producers and processors are protecting themselves against the risk of further price increases by selling futures.

-

The rise in commercial short positions suggests the supply side of the market expects high prices and is actively hedging.

Managed Money (Speculative Funds)

-

Clearly on the long side: 16.9k long vs. 10.1k short.

-

This indicates speculative capital is still betting on higher cocoa prices, despite heavy commercial shorting.

-

Over the past week, speculative funds added around +1.5k new short contracts, hinting at growing caution.

Takeaways from the Positioning

-

A classic clash of roles is visible: producers remain defensive (short), while funds maintain the upper hand on the long side.

-

Such a setup often means the market stays under supply pressure, but speculative money still supports the upside.

-

With commercials increasing shorts and funds cautiously adding to shorts as well, the market may enter a consolidation phase, with some risk of profit-taking after recent gains.

Commercials are heavily hedging against high prices, while managed money continues to bet on further upside – though with slightly more caution than before. This points to a potentially more pressure on managed money (large speculators) positioning, if the grinding data would signal slowing processing demand on chocolate and other cocoa-related products.

Source:CFTC

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment