Oil:

- Gibraltar releases captured Iranian tanker

- United States still want to prevent the tanker from reaction its destination (allegedly Syria)

- Tanker seems to be heading to a port in Greek tourist resort. Ship-to-ship oil transfer seems more and more probable in this case

- Potential for re-escalation of tensions in the Gulf region buoys oil prices

- CFTC data hints that investors are getting more bearish on oil

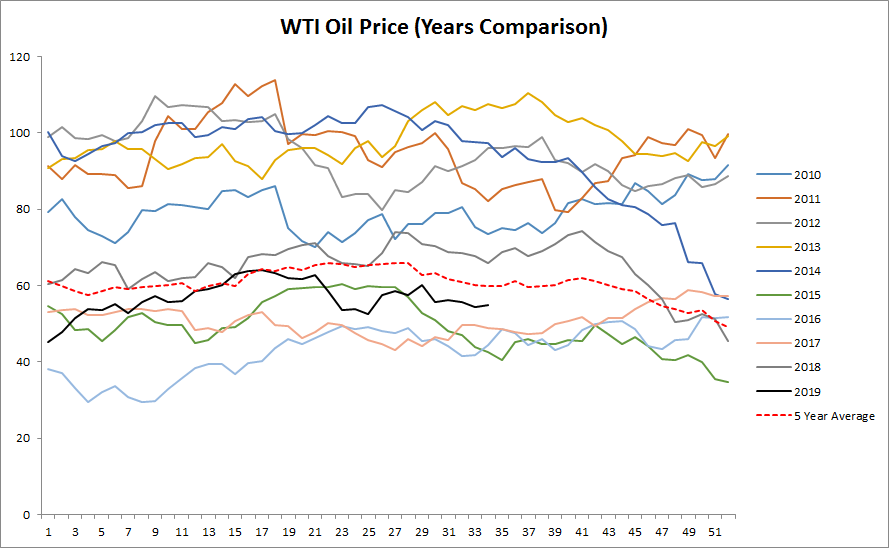

- Oil prices are relatively low in comparison to the previous decade. According to the 5-year average, some kind of stabilization may take place in the months to come

This year’s performance of oil looks quite flat. According to seasonality, more sideways trading may occur in the near term. Source: Bloomberg, XTB Research

This year’s performance of oil looks quite flat. According to seasonality, more sideways trading may occur in the near term. Source: Bloomberg, XTB Research

Net speculative positioning for oil is not flashing any signals yet but one should keep in mind a significant increase in the number of open short positions. Source: Bloomberg

Gold:

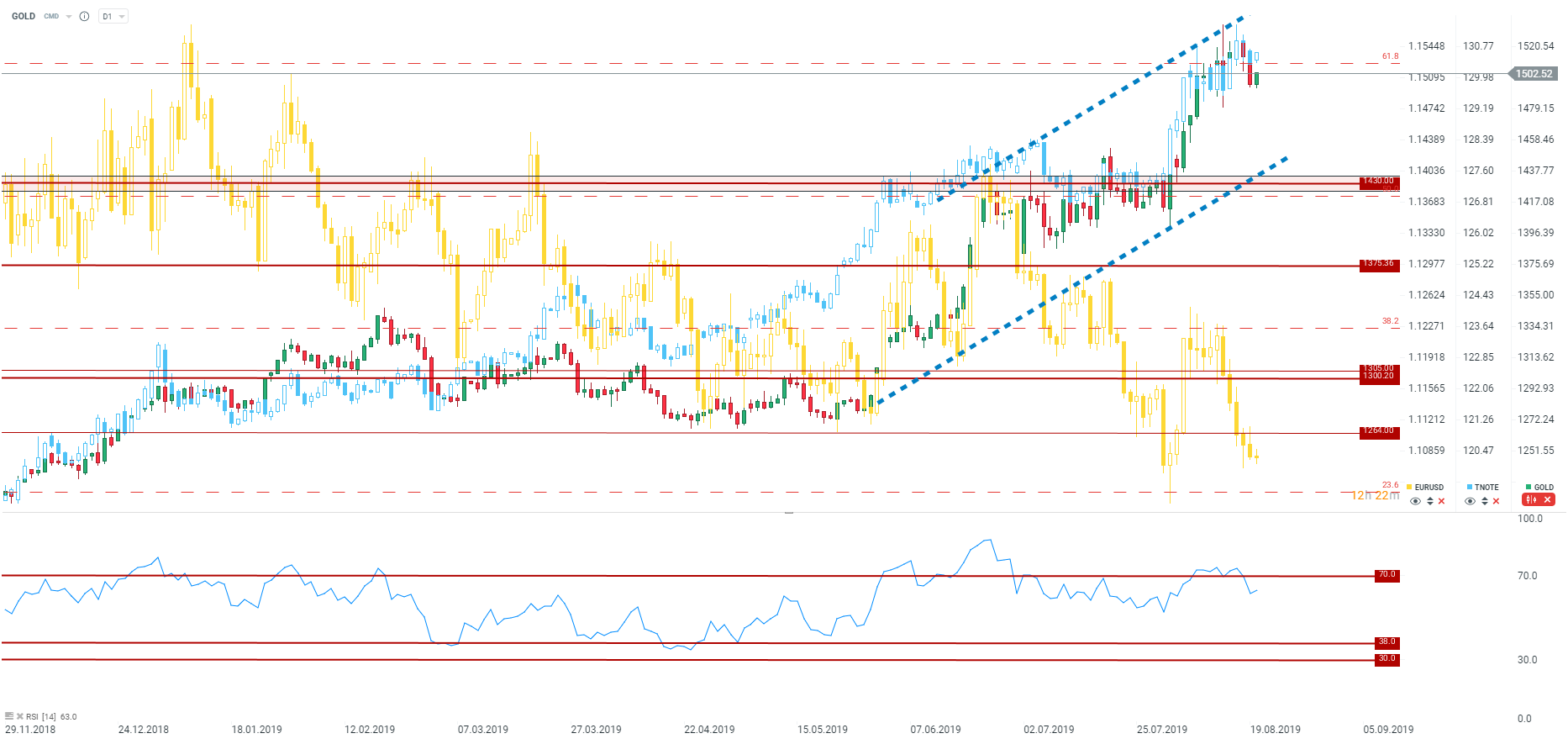

- Gold halts advance at key technical level - $1500 handle that is marked with 61.8% Fibo level of the downward wave from 2012-2015 period

- Speculative positioning flashes a contrarian signal

- Gold looks fairly valued when we take into account bond market. However, USD hints at lower price of the precious metal

- Options markets signals overheating of the gold market. A correction could take place from current levels

- Gold may trade sideways in the $60-wide range in the weeks to come. Upper limit of the consolidation range in the $1500-1520 area

Net speculative positioning on gold is at extreme high flashing a contrarian signal. Source: Bloomberg

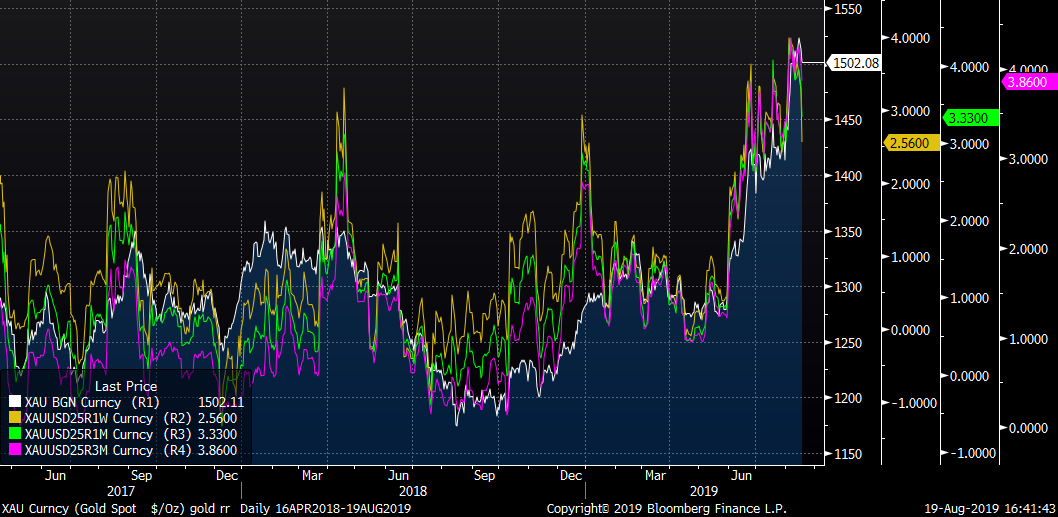

Options market hints at overheating of the gold market, especially over the near term. Source: Bloomberg

Options market hints at overheating of the gold market, especially over the near term. Source: Bloomberg

Gold looks fairly when we consider bond market and overvalued when we consider USD market. Source: xStation5

Gold looks fairly when we consider bond market and overvalued when we consider USD market. Source: xStation5

Corn:

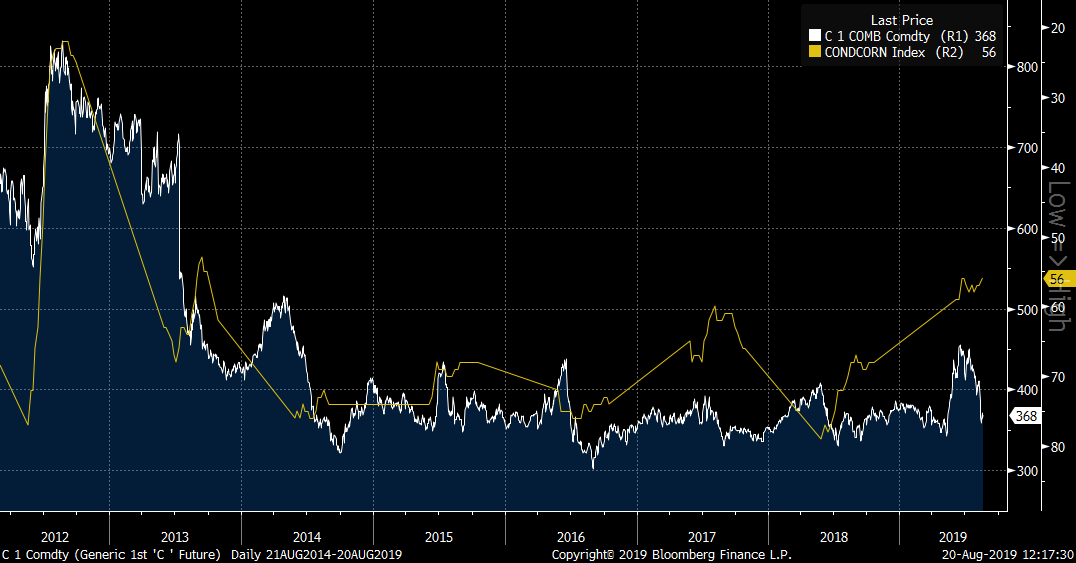

- The latest WASDE report showed a sizeable increase in ending stocks (+171 million ton to 2181 million ton)

- A slight deterioration in weather conditions as well as exports prospects has taken place of late, the stocks to consumption ratio has bounced back botably

- Ukraine’s corn production is forecast to be close to record levels

- Weaker crop conditions in the US, however, rainfalls are expected to occur in the coming weeks

- Weak demand prospects keep corn prices close to this year’s lows

Crop conditions are low. Weather is still among the key factors affecting corn prices. Source: Bloomberg

Crop conditions are low. Weather is still among the key factors affecting corn prices. Source: Bloomberg

Cocoa

- Ghana will lift a price for farmers by 5.2% in the 2019/2020 season, the first such a move for four years

- The price increase stems from strong sales for exports, higher prices can also arise in Ivory Coast

- Ghana has produced as many as 800k tons of cocoa so far this season, up 11.7% y/y

- Cocoa prices are falling below the pivotal support levels: $2200 per ton, the 61.8% retracement as well as the upward trend line

Cocoa prices have fallen below the key support. It is worth mentioning that we are already behind the mid-season, thus incoming information regarding the next season could be critical. Source: xStation5

Cocoa prices have fallen below the key support. It is worth mentioning that we are already behind the mid-season, thus incoming information regarding the next season could be critical. Source: xStation5

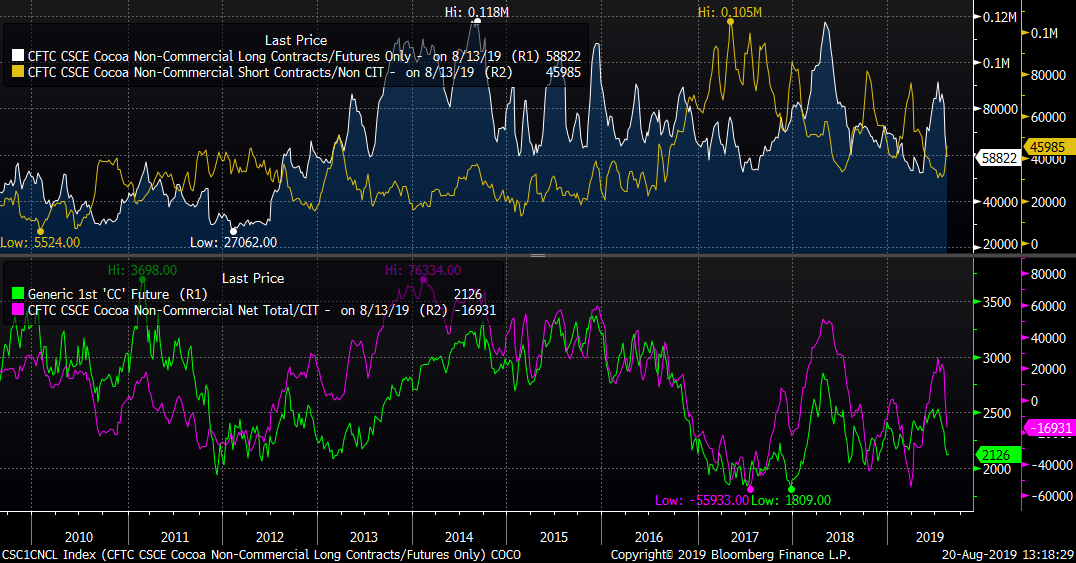

Speculative investors have already begun exiting longs and opening shorts of late. From this standpoint there is still some space for declines. Source: Bloomberg

Speculative investors have already begun exiting longs and opening shorts of late. From this standpoint there is still some space for declines. Source: Bloomberg

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?