Oil

-

Bank of America sees a high chance of Brent price returning above $90 per barrel quickly amid Chinese reopening and a Fed pivot

-

On the other hand, Citi lowered its Brent price target from $88 to $80 per barrel by the end of 2023

-

US Department of Energy wants to start refilling strategic reserves as quickly as possible, even though it was earlier said that refilling will begin when prices drop below $70 per barrel

-

Oil prices rebound amid a lower supply in the United States where the Keystone pipeline remains shut following last week's oil spill. Keystone pipeline had a capacity of over 600k barrels per day

-

Russia threatens to lower production should third-party countries embrace Western price cap

-

Open interest on the oil market continues to drop. OI sits at the lowest level since 2014. In case number of open positions rebounds soon, oil market may become more active in the coming weeks

-

Oil is trading in a divergence to EURUSD. Should Fed decides to pivot its policy, commodities may benefit from weaker USD

Open interest on WTI and Brent sit at the lowest level since 2014. The latest rebound looks promising but does not stand out in a recent downtrend. Source: Bloomberg

Open interest on WTI and Brent sit at the lowest level since 2014. The latest rebound looks promising but does not stand out in a recent downtrend. Source: Bloomberg

WTI is trading in a significant divergence to EURUSD. Source: xStation5

WTI is trading in a significant divergence to EURUSD. Source: xStation5

Gold

-

Gold continues to trade below $1,800 per ounce and awaits a hint from EURUSD and TNOTE (yields)

-

It is expected that Fed will hit a dovish note this week, what may allow gold price to jump above $1,800 per ounce

-

Taking a look at gold speculative positioning data, we can see that shorts continue to be covered while longs continue to be opened. However, pace of those changes is very slow

-

ETFs continue to sell out their gold holdings but further drop in US yields could see this trend reverse

Number of open long positions on gold continues to increase while the number of open shorts continues to drop. Source: Bloomberg

Number of open long positions on gold continues to increase while the number of open shorts continues to drop. Source: Bloomberg

Gold painted a double top in the $1,800 per ounce area and a dovish tilt from Fed could help trigger another attempt at breaking above this hurdle. Source: xStation5

Gold painted a double top in the $1,800 per ounce area and a dovish tilt from Fed could help trigger another attempt at breaking above this hurdle. Source: xStation5

Natural Gas

-

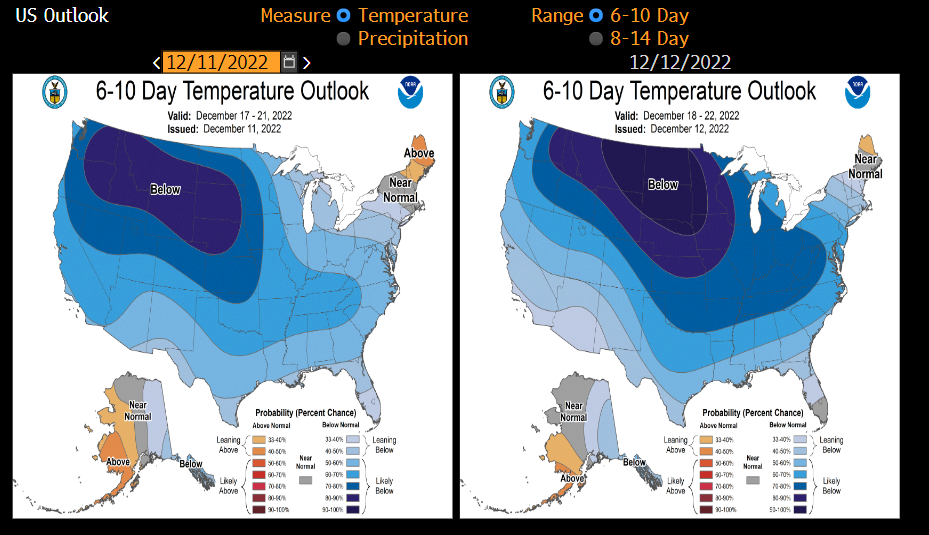

US natural gas prices jumped at the beginning of this week amid a drop in temperatures in the United States

-

Forecasts in the previous week hinted that US temperatures will remain at above-average levels. However, new forecasts point to a significant drop in temperatures

-

The upcoming EIA natural gas report may still not reflect increased demand due to lower temperatures

-

European natural gas prices drop slightly as LNG imports to Europe remain elevated and gas consumption remains lower than average for the period. On the other hand, a drop in temperatures in Europe may lead to quick jump in consumption

-

Issue of deliveries to European countries next year remains unresolved

US weather conditions deteriorate significantly, hinting at higher natural gas demand in the year's end period. Source: Bloomberg

US weather conditions deteriorate significantly, hinting at higher natural gas demand in the year's end period. Source: Bloomberg

US natural gas prices (NATGAS) launched a new week with a significant bullish price gap. Seasonal patterns hint at a potential for range trading in December with attempts at breaking above the range. Speculative positioning on natural gas remains depressed. Source: xStation5

US natural gas prices (NATGAS) launched a new week with a significant bullish price gap. Seasonal patterns hint at a potential for range trading in December with attempts at breaking above the range. Speculative positioning on natural gas remains depressed. Source: xStation5

Coffee

-

In spite of chatter on limit coffee supply, Brazilian exports rebound significantly

-

Cecafe informs that green coffee exports reached 3.39 million bags in November and was 19.2% YoY higher. All coffee exports were 14.2% YoY higher

-

Simultaneously, Cecafe highlights that logistics are in much better condition than a year ago but still far from perfect

-

International Coffee Organization points to moderate increase in demand until the end of the decade (1-2% per year). Previous forecasts pointed to an annual growth of 3.3%

-

Lower increase in demand is driven by pick-up in inflation in Europe as well as by Russia-Ukraine war. Moreover, economic slowdown is also playing its part

-

ICO also expects coffee market to move out from current small deficit to get balanced in the next 2-3 years

-

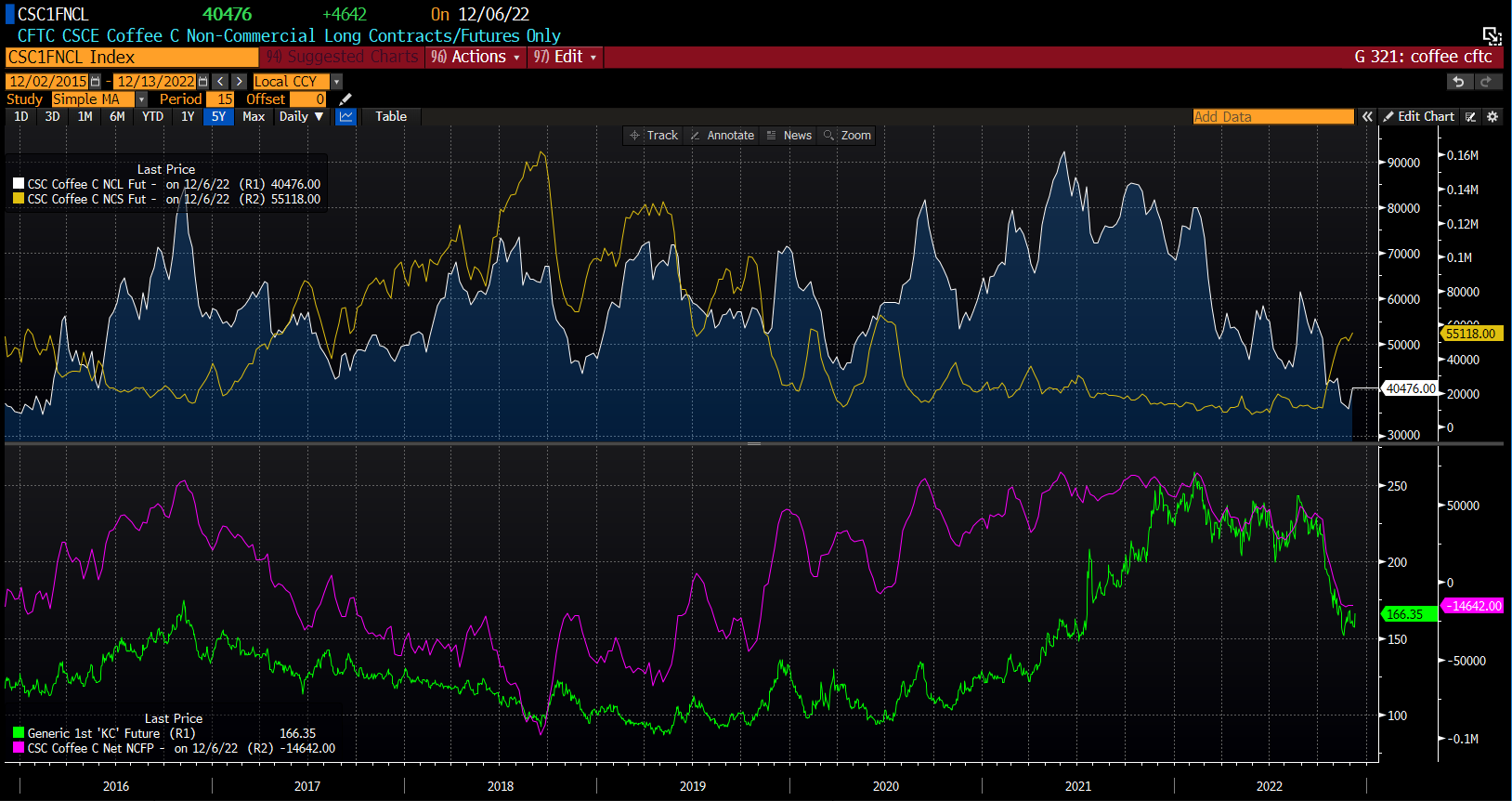

Coffee stockpiles on exchanges remain low but start to rebound. Low coffee prices are supported by strong BRL and noticeable increase in the number of open short positions

Speculative positioning on coffee still supports a bearish price scenario. However, it should be noted that number of open long positions started to rebound. Source: Bloomberg

Speculative positioning on coffee still supports a bearish price scenario. However, it should be noted that number of open long positions started to rebound. Source: Bloomberg

Coffee prices halted sell-off near 61.8% retracement of the last upward impulse. However, fundamental outlook remains mixed. USDBRL is trading in a range and potential Fed pivot could support BRL as USD weakens. This would support further declines on the coffee market. Source: xStation5

Coffee prices halted sell-off near 61.8% retracement of the last upward impulse. However, fundamental outlook remains mixed. USDBRL is trading in a range and potential Fed pivot could support BRL as USD weakens. This would support further declines on the coffee market. Source: xStation5

VIX drops 10% amid Wall Street rebound attempt🗽

3 markets to watch next week - (17.10.2025)

Precious metals decline 📉Gold down 2%; Silver loses 4%

Morning wrap (17.10.2025)